Revisiting Warner Bros Discovery: A Tale of Ambitious Mergers, Market Realities, and Survival in the Streaming Era

An Analysis on WBD's Performance and Post-Mortem of the Investment Thesis Since the Merger

$WBD Valuation on Publish Date

Price Per Share (Close): $10.35

Market Cap: $25.24 billion

Enterprise Value: $79.7 billionOutline

Executive Overview

From Rosy M&A Forecasts to Painful Realities

Evaluating the Operating Performance

Revenue

Profitability

Debt

Segment Analysis

Networks

Studios

DTC

Final Thoughts

Executive Overview

In April 2022, Warner Bros Discovery WBD 0.00%↑ completed its Reverse Morris Trust Spin-Off Merger with AT&T, a move precipitated by the media industry's shifting landscape. Under the stewardship of CEO David Zaslav, this newly merged entertainment behemoth is navigating through a tumultuous period marked by secular linear TV declines, increasing competition from serious competitors, two strikes that halted scripted production for months, and a massive pile of debt. Although management has implemented crucial strategic initiatives to reduce debt and bolster the company's position in the streaming era, the performance following the merger has not met anticipated expectations.

In many ways, this story reminds me of LEE 0.00%↑, which I passed on because I thought it would be unlikely for the massively leveraged company to replace large and declining legacy print cash flows with its growing digital business to compensate shareholders sufficiently. Unlike the Lee story, I was convinced that the newly combined company would perform better with a better management team coming in to fix things up and improve returns on capital. The results have thus far been disappointing, with billions of dollars of value lost for shareholders since the deal's close. This calls for a thorough reassessment of my May 2022 analysis and the trajectory of events since then. While the situation has thus far not worked out, the unfolding story could still present an opportunity in 2024, a year of international expansion for Max, advertising tailwinds, and the monetization of a new sports tier. The company remains a part of my portfolio, albeit under much closer scrutiny. While the performance thus far has been subpar, it became a fruitful (and painful) learning experience.

From Rosy M&A Forecasts to Painful Realities

The operating performance of Warner Bros Discovery is underwhelming, especially when contrasted with the optimistic projections presented by AT&T and Discovery in 2021. At that juncture, Discovery's David Zaslav recognized the urgent need to scale quickly to remain competitive. Concurrently, AT&T's CEO, John Stankey, was pressured to divest assets amidst a staggering debt load of nearly $238 billion. WarnerMedia, a standalone subsidiary of the old telecom business, was ill-equipped to compete independently. AT&T's strategy of leveraging a content company to boost engagement across its mobile, broadband, and cable services had not worked out.

AT&T was incentivized to present the divested asset as attractively as possible to the shareholders of both companies, given it would retain a 71% stake in the new entity. Similarly, Discovery endeavored to persuade its shareholders of the significant upside of the merger despite its hefty $83 billion price tag1. However, the reality of the performance since then stands in stark contrast to the initial projections, bringing to light the challenges and empty promises typical of such corporate mergers.

In May of 2021, Discovery’s 2023 projections called for “revenue of roughly $52 billion” with $14 billion of EBITDA and a free cash flow conversion rate of ~60%, translating to $8 billion in 2023 free cash flow with the benefit of synergies.

Management projected $3 billion in synergies, presumed to be realized within two years. These synergies were essential to rapidly reducing the company's ~$56 billion debt load, aiming to reduce gross leverage to less than 3x within this timeframe. This ambitious goal was set against the 2021 pro forma figures of ~$45.4 billion in sales and $10.6 billion in EBITDA, underscoring the opportunity to streamline the combined operations and significantly improve the economics in a relatively short period.

On the DTC side, the combined companies approached revenues of $10 billion2 from 100.7 million subscribers—76.7 million from WarnerMedia and the remaining from Discovery+. Of the $52 billion in expected sales for 2023, Discovery expected “at least $15 billion” from DTC.

The merger transaction was officially completed on April 8th, 2022, and the newly formed Warner Bros Discovery conducted its inaugural Q1 conference call two weeks later. On the call, CFO Gunnar Wiedenfels disclosed a concerning discovery. Despite WarnerMedia generating over $40 billion in revenue in the preceding fifteen months, the operation had produced "virtually no free cash flow." However, it wasn’t until the subsequent earnings report that the management could thoroughly assess WarnerMedia’s operations. In this report, management relayed more disappointing news to investors: approximately $2 billion in 2022 EBITDA was negatively impacted by missed revenue opportunities and poor investments made by AT&T. Consequently, the company adjusted its 2023 EBITDA forecast down from $14 billion to $12 billion. Not surprisingly, this downward revision bolstered management’s confidence in achieving $3 billion in synergies by 2023, as there was now more of a mess to clean up.

“I have full confidence that we will expect at least $3 billion of synergies overall, with $2 billion to $3 billion of synergy realization in 2023.”

CFO, Gunnar Wiedenfels | Q2 2022 Conference Call

The fun didn’t stop there. The Q1 total subscriber count was revised downwards by 10 million to 90.7 million, attributing this to an overstatement by AT&T. The original number included unactivated accounts that had received HBO Max as part of a bundle under AT&T’s “Mobility distribution agreement.” Understandably, this significant adjustment led to shareholder lawsuits, adding to the company's challenges in navigating the post-merger landscape.

Taking a closer look at the footnotes, however, it does appear that AT&T disclosed “subscribers receiving access through bundled services with affiliates that may not have signed in“ on the Q1 2022 Trending Schedule. Admittedly, I overlooked this footnote inflated AT&T’s numbers. Details are important!

In the face of this bad news, management attempted to reassure investors with an optimistic DTC guide of $1 billion in EBITDA by 2025, 130 million subscribers by 2025, and 20% long-term margins, including incremental 50% margins.

Not surprisingly, the guidance was not good enough for the market, and investors’ confidence in management turning things around amid the linear decline dwindled. Since the merger, the stock has dropped over 50%.

The market's persistently negative sentiment towards the stock is justified as the underlying combined asset has thus far shown to be weaker than initially perceived. Several other factors played a significant role in shaping this outcome. These included the ongoing decline of linear TV and the shift of advertising spend to digital platforms, the intensely competitive landscape of the entertainment industry marked not only by streaming services but also by popular video platforms like YouTube and TikTok, stagnating DTC growth, a heavy debt burden, escalating costs for sports broadcasting rights and content, and the impact of rising interest rates.

Evaluating the Operating Performance

Now that we are at the beginning of 2024 let’s evaluate how the business has performed relative to the initial expectations.

Revenue

In the S4 filing, Discovery had originally projected a combined revenue of $51.7 billion for 2023, a 14% increase from the 2021 pro forma figures. However, the company's trajectory has deviated from these expectations, with a recent 5.6% quarterly decline bringing revenue down to $42 billion. This downturn was primarily due to a 15% drop in Studios and an 8% decrease in Networks sales. On the brighter side, the DTC segment saw a modest YoY increase of 5%. Additionally, a significant reduction of $1.15 billion in corporate-level revenue eliminations reflects a strategic shift from internal to external licensing deals.

In retrospect, management's ambition to grow DTC revenue by $5 billion in under two years and increase Studios sales in a post-pandemic environment while maintaining Networks revenues was shortsighted. Notably, the decline in the linear TV business was significantly more pronounced than anticipated, which was an oversight in my pre-merger analysis. While Max still holds tremendous promise and is probably in the early days of monetization, particularly with sports and subscriber growth, it has a lot of ground to cover to make up for the highly profitable declining linear revenues, especially in advertising, where legacy revenues are nearly 18x streaming.

Post-Mortem

The competitive strength of Warner Bros Discovery proved to be more fragile than I had initially predicted. While aware it didn't match the robustness of other companies I've examined, such as Nvidia, Wise, and UMG, the situation was more challenging than expected. Reflecting on my original analysis, I realize I did not adequately consider the adverse factors impacting WBD's position within Michael Porter’s Five Forces framework. These factors included fierce competition, a wide array of consumer entertainment options (rivalry from existing competitors and substitution threats from new media), disruptive industry shifts, and the challenges of the digital transformation. Specifically, I failed to account for the declining trend in traditional advertising revenues and the challenges faced by WBD's theatrical content in a market that has become both increasingly competitive and influenced by post-pandemic dynamics.

My original evaluation was overly optimistic about DTC growing quickly. I envisioned a product positioned and scaled to immediately challenge Netflix, backed by similar capital spend on content and a century of content production experience. However, anticipating a 50% growth in just a year and a half from a $10 billion base proved too ambitious. This projection did not fully account for the complexities and challenges of the DTC consolidation phase. Additionally, the inability to adequately protect itself from competition hurt its earnings power. In the era where the mantra was 'growth at all costs' and the focus was on producing a vast amount of content, the company's industry peers pursued a similar strategy, leading to a significant rise in content production costs. As the company pivots towards selling and extensively licensing its content, its peers are adopting similar strategies. This collective shift has led to an oversupply of content in the market, consequently diminishing the company's pricing power.

Profitability

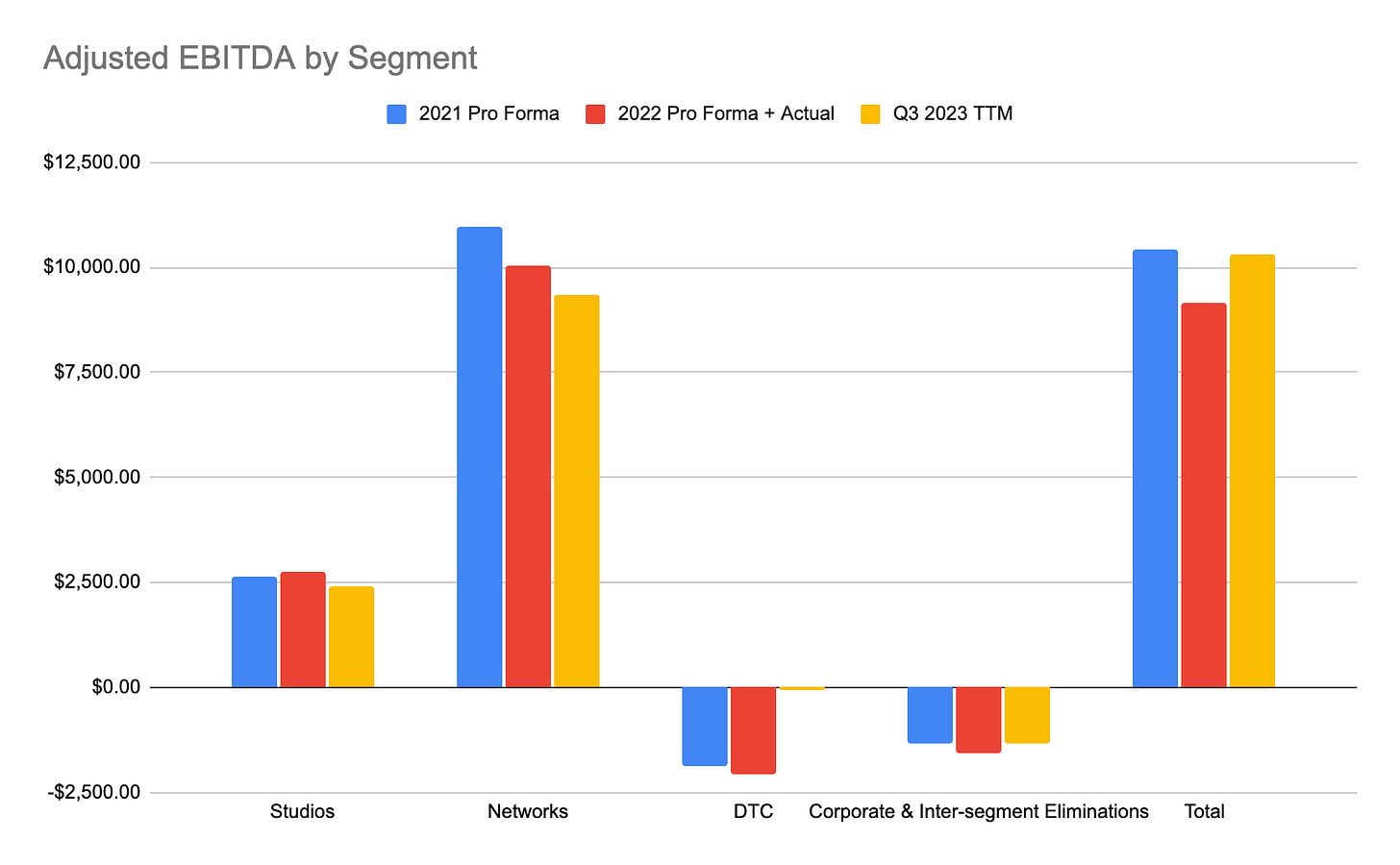

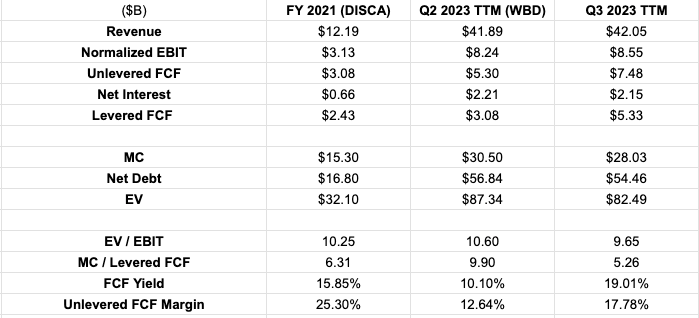

Despite the revenue decline, the company grew Adjusted EBITDA by 11% to $10.3 billion. Pre-merger management expected $14 billion with $8 billion in Free Cash Flow (FCF). As I mentioned, this was revised sharply to $12 billion, with FCF landing somewhere between $4 billion and $6 billion, which was implied from a 33%-50% FCF conversion target.

“Based on the full-year impact of our 2022 corrective actions and $2 billion to $3 billion of synergy realization in 2023, we expect adjusted EBITDA to be at least $12 billion. We expect to convert approximately third to half of our adjusted EBITDA into free cash flow in 2023 as we make progress towards our long-term target of approximately 60%.“

CFO, Gunnar Wiedenfels | Q2 2022 Conference Call

Although the fourth quarter results are yet to be reported, Warner Bros Discovery's profitability has already shown to be below initial expectations, performing even more poorly than revenue. However, the post-merger performance on cash flow was somewhat redeeming, with FCF conversion reaching the higher end of the anticipated range. In the first four quarters of combined operations (through Q2 2023 TTM), the company generated $3.08 billion in free cash flow from $8.2 billion in Normalized EBIT3. For context, Discovery, as a standalone, generated $2.42 billion of FCF in 2021. A paltry ~$700 million first-year cash flow increase in return for handing over $42.3 billion in equity. Ouch!

However, Zaslav and Co. were ruthlessly capturing synergies and improving capital allocation. One quarter later, cash flow improved. WBD generated $8.55 billion in TTM EBIT and $5.3 billion in levered cash flow ($7.5 billion unlevered!) after a YoY FCF swing from -$200 billion to $2.1 billion in Q3 2023. This uplift was the confluence of several tailwinds, such as realizing synergies, closing the gap between amortization and content spending, using working capital more efficiently, and getting a one-time benefit of several hundred million in strike-related savings. This is also without any interest savings despite the billions in debt it paid down since the company had to hustle to reduce the $7 billion in floating rate debt heading into the challenging rising interest rate environment. Since then, it has paid down most of that with only a little over $1 billion left, which should be mostly paid off in the next few quarters.

There is a mixed bag of puts and takes for FCF this year. On the plus side, there should be $150-$2004 million in interest expense savings, $1 billion of cash cost to achieve synergies eliminated, working capital improvement, further narrowing of the content amortization gap, cost-cutting, and increased EBITDA from increasing DTC profitability. The new year should also have a surprisingly better theatrical slate despite having to comp Barbie and catch up from production delays caused by the 2023 strikes. Thanks to the US elections and the Olympics, a cyclical uplift in advertising revenue is also expected. On the negative side, the non-cyclical pressure on U.S. advertising should continue, several hundred million in cash savings from strikes will go away, and incremental growth investments, including marketing Max globally, will kick off as the international expansion begins.

Conversely, there are non-trivial challenges facing the business. The non-cyclical pressure on U.S. advertising is likely to persist. The financial benefits accrued during the strikes, amounting to several hundred million in cash savings, will dissipate. Additionally, as the international expansion gets underway, substantial investments in growth are anticipated, including global marketing initiatives for Max.

Post-Mortem

The recent operating performance of Warner Bros Discovery presented a difficult reality to accept, as it exposed an error in my evaluation of the merged entity's earnings potential. This led to an inflated estimation of the Enterprise Value, creating the misleading impression that the stock was more attractively priced than reality.

Normalized Operating Earnings: (2023) Estimates: $14.9 billion vs. Actual: $8.5 billion

This stark contrast in earnings power stemmed from two primary oversights.

First, there was a notable misjudgment in revenue projection: I had estimated $50 billion, whereas the actual figure was $42 billion.

Second, my initial decision to remove growth capital expenditures, estimated at $4.4 billion or 20% of the total projected capex, from cap-ex to arrive at operating earnings (EBITDA - maintenance cap ex) was flawed. Growth capex is generally pertinent to businesses with clear growth prospects that can incrementally invest at rates of return above the cost of capital. However, WBD is currently at a stage where it must make incremental investments in fixed capital and content spending to maintain its earnings power. Without a material shift in its bargaining power, any incremental capital deployed is defensive at best, leading to diminishing returns on capital. Even without considering this growth capex, the projected operating earnings of $10.5 billion were also overestimated. However, it would have been more defensible on $50 billion in revenue with a 21% operating margin, which is just 1 point higher than its actual margin. This miscalculation highlights the need for a more disciplined approach in factoring growth cap ex. Grounding it in the reality of the company’s position in its industry and its prospects for high returns on incremental capital despite rosy projections from management.

Normalized Free Cash Flow: Estimates: $6.3 billion vs. Actual: $5.3 billion

While my FCF estimate was closer to reality than operating earnings, I was aided by lower-than-anticipated fixed costs. My initial forecasts overestimated these costs, not accounting for reduced content spending due to industry strikes and management's ability to cut expenditures post-merger.

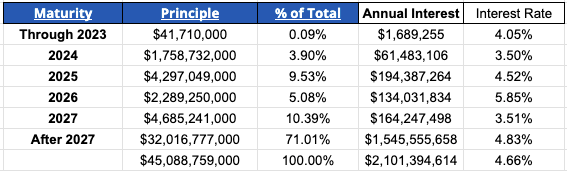

Debt

The company faced a substantial challenge at its inception, starting with around $56 billion in gross debt and an Adjusted EBITDA leverage ratio of 5.9x. Since then, the ratio has been reduced to 4.36x, with gross debt at $44.8 billion ($43 billion net) and $10.3 billion EBITDA.

It should be able to easily handle its debt servicing with only $8.3 billion maturing through 2026 and cash flows covering interest several times over. In total, $5.9 billion in FCF, $2.4 billion in cash from Warner’s balance sheet, a $1.2 billion post-close working capital settlement check from AT&T, and existing balance sheet cash enabled it to pay down $11.2 billion. Despite this rapid debt reduction, the outcome was disappointing as management told the street that it would be less than 3x levered within two years, an improbable goal with just two reportable quarters remaining.

The company's leverage expectations evolved dramatically. On the Q2 2022 call, the first for the merged entity, management reiterated a long-term gross leverage target of 2.5 to 3x, aiming to achieve this by the end of 2024. By Q4, while still committed to this target, a new goal was set to reduce net leverage to below 4x by the end of 2023. However, the Q3 2023 call brought further adjustments. While the < 4x net leverage target remained, management conceded that hitting the 2.5x-3x gross leverage target by Q4 2024 seemed unlikely without a significant uptick in the TV advertising market.

Initially, with projections of $14 billion in adjusted EBITDA and $8 billion in FCF for 2023, CEO David Zaslav and CFO Gunnar Wiedenfels anticipated reducing the leverage ratio to under 3x relatively quickly. In this scenario, the team would only need to lower the debt to $42 billion. If 2022 and 2023 FCF targets were met, WBD would have generated about ~$11.5 billion5 in cash flow, surpassing the actual $8.3 billion6 achieved. This would have positioned the company with approximately $40 billion in gross debt rather than the $43 billion expected at the end of Q4. With $8.5 billion in EBIT and $81.7 billion in EV, the business is trading for just under 10x. Not a massive discount by any means.

The destruction of capital from those revisions is material. If the original EBITDA target held, you would be looking at ~$3.5 billion in incremental EBIT, equating to ~$35 billion in additional EV. If you also account for $3.2 billion in less FCF paid down over time, there is a total loss in equity value of $38 billion, or 1.4x the current market cap. This is pretty rough. However, the good news for owners is that IF cash flow remains steady, the business should be able to retire $5.5 billion in additional debt annually or a ~20% increase in equity.

Post-Mortem

It's one thing to underestimate future earnings power but another to miscalculate current financials. In the interest of transparency, I must acknowledge a gap in my original model: the net debt at the end of 2021 was estimated at $44 billion, while the actual figure was $51 billion. This discrepancy largely stemmed from a significant overstatement of cash, which I failed to update from the latest figure from the post-merger 8K filing. Such an oversight had a material impact on my projections for subsequent years and the valuation of the security's equity. Moving forward, I am committed to improving the precision of my work by thoroughly verifying all calculations.

In calculating net debt, I initially failed to account for crucial components: net Deferred Tax Liabilities (DTLs), minority interest, and leases. These elements are real expenses for shareholders and should be factored into a thorough financial analysis. For instance, as of the end of Q2 2022, the company had $13.6 billion in DTLs. This is a noteworthy issue, considering that the $4.8 billion paid toward DTLs in 2022 and 2023 was not available for debt repayment. I have since revised my approach to include these liabilities when calculating net debt.

Segment Analysis

It’s no secret that WBD depends heavily on its Networks segment, a substantial source of cash flow that accounts for 90% of its Adjusted EBITDA and is facing a secular decline. The challenge for CEO David Zaslav and his team extends beyond reducing debt. A crucial part of his strategy involves extending the life of the Networks division while concurrently improving the profitability and economics of the DTC and Studios businesses, which are critical pieces for the business moving forward.

This strategic path is laden with execution risks, requiring shareholders to trust WBD’s leadership to handle these challenges adeptly while digitally transforming the rest of the business. The headwinds are numerous: linear subscribers are declining at an annual rate of 5-6%, advertising budgets are increasingly shifting towards digital channels, the streaming market is becoming more competitive, and the benefits of synergies will eventually run out and successfully digitally transform the business. Confidence in the management's ability to effectively navigate these headwinds is critical for ongoing shareholders.

Networks

Since assuming the role of CEO at Warner Bros Discovery, David Zaslav has faced considerable challenges with Networks. While distribution revenues have been relatively stable, thanks to affiliate rate increases offsetting subscriber losses, the rapid decline in linear advertising revenues is a significant concern. Zaslav has acknowledged the industry is undergoing a "generational disruption" driven by the cord-cutting trend. According to Magna, linear TV ad revenue declined 7% YoY in 2023.

However, Warner Bros Discovery's struggles do not just reflect broader market trends. Linear advertising TTM revenues fell by 14.32% YoY, a decline that starkly underperforms the market average. This discrepancy indicates that its challenges are not merely due to external market forces. It is concerning that management tends to attribute these issues primarily to the market rather than ultimately owning up to execution failures.

The underperformance of the linear segment is multi-faceted, but I believe the most significant factor is its comparatively low investment in sports broadcasting rights. The CEO has highlighted that the company's linear channels command a substantial viewership share, reaching 25% on any night and up to 40% during NBA games. However, this advantage hasn't effectively translated into tangible financial gains. WBD holds rights to the NBA, NHL, March Madness, and MLB, yet it ranks only as the fourth-largest spender on sports rights. In the current media landscape, sports are more crucial than ever as the glue that keeps the cable bundle from falling apart, with at least 40% of linear subscribers drawn to live sports, accounting for 31% of advertising revenue.

Management missteps during the 2022-2023 TV upfront cycle further complicated the company’s position. The company focused on increasing Cost Per Thousand Impressions (CPMs) rather than securing higher ad volume. However, the expected demand didn't materialize as WBD realized its pricing power wasn't as good as it thought. Advertisers were also busy shifting their spending to digital channels or reducing their budgets in anticipation of an upcoming recession. Under normal market conditions, this strategy might have been successful, allowing WBD to compensate for lower volume by selling into a more robust scatter market. However, facing these unexpected market realities, management revised their strategy for the 2023 upfronts, prioritizing volume over price. With upfront contracts starting in Q4, the effectiveness of this course correction and its impact on WBD's performance remains to be seen.

2024 is shaping to be a more favorable year for WBD, buoyed by two major cyclical tailwinds: the upcoming presidential election and the Paris Olympics. These events are expected to provide a reprieve from the ongoing secular decline in the industry. Magna forecasts a 4.3% growth in linear TV advertising for the year, suggesting that the decline should pause temporarily. This stability could provide a small window for the company's DTC segment to expand internationally during Max's critical year of growth. However, uncertainty looms post-2024, particularly with the fate of the NBA rights for the 2025/2026 season hanging in the balance. CEO David Zaslav's assertion that WBD doesn’t have to have the NBA seems questionable; arguably, these rights might be more crucial than ever. The NBA and other sports broadcasts are vital for cross-promoting WBD's diverse content, a strategy that has proven wildly successful for promoting shows and movies like "Barbie," "House of the Dragon," "Succession," and "The Last of Us." Lastly, the recent Disney-Charter agreement in September could provide more runway and signify an industry-wide shift towards more mutual efforts of distributors and content providers to extend the life of cable TV. Including DTC streaming apps in cable bundles could help decelerate the trend of cord-cutting, a development that would positively impact future cash flows.

Studios

With a 15% YoY TTM decrease in performance, Studios have fared even worse than Networks. Although this segment has a lesser impact on Adjusted EBITDA, contributing nearly 25% to the bottom line, it was especially meaningful as it exacerbated the downward pressure on profitability. The decline can be attributed to reduced TV licensing revenues and challenging comparisons with the previous year's successes, notably Batman and the Lego Star Wars game. A relatively weak 2023 movie lineup has also contributed to this decline. However, it's worth noting that the outstanding success of Barbie and Hogwarts Legacy partially mitigated these negative factors.

Despite recent disruptions caused by strikes, the segment is poised for improvement in the coming years, driven by a robust film lineup with plans for “twice as many theatrical releases,” a revitalization of the DC franchise, and increased investment in the very profitable WBD Games unit. It's important to note that the new regime has thus far been at the mercy of scripted content created under the previous leadership, given that theatrical productions typically take 2-3 years from inception to completion. Zaslav is dedicated to producing high-ROI content, evident in the complete overhaul of the DC universe and a strategic focus on underexploited blockbuster IPs like Lord of the Rings and Harry Potter. This approach contrasts the previous regime’s tendency to approve content without regard to return on capital, primarily to boost DTC subscriptions.

According to Gunnar, WBD Games is poorly monetized and was “stunned” that they have not invested more. This smaller unit has averaged $400 million EBITDA over the past three years, and there is much more that they can be doing, such as “always on” gameplay through live services, free-to-play extensions, and other opportunities to generate post-purchase revenue, which sounds like high margin microtransactions to me.

I've double and triple-checked some of the metrics here because it's such a great investment opportunity. I'm stunned that we haven't been investing more into this opportunity under JB's and David Haddad's leadership here, and I think we have to do more. There's a lot more opportunity there and we're going to start tackling that.

CFO, Gunnar Wiedenfels | Q3 2023 Conference Call

Studios' segment profitability will massively benefit if the company can lengthen the monetization cycles of its video games and continue to milk the IP throughout instead of relying on the initial one-time sale. Hogwarts Legacy validates the thesis of the value of the company’s IP, even among younger generations, as it is the highest-grossing video game of 2023. With a highly engaging game like this, microtransactions may have a significant upside, considering a company like Activision Blizzard generated 61% of its profits from microtransactions in 2021.

Examining recent transactions, like Microsoft's acquisition of Activision Blizzard at ~20x EBITDA, and considering the average multiples of 20-30x for companies like EA and Take-Two Interactive over the past five years, a valuation for the gaming division could realistically fall in the range of $6-$8 billion. This estimate is based on a multiple of 15x-20x EBITDA, representing about 7-10% of the entire business's enterprise value.

DTC

The company has placed a significant bet on DTC in response to cord-cutting. The company's strategy has evolved considerably under the leadership of David Zaslav, who took the helm when the segment reported a $2 billion EBITDA loss on $9.7 billion in revenue. Initially, like many of its peers during the AT&T-led WarnerMedia era, WBD pursued subscriber growth at any cost, a strategy that Wall Street once rewarded with high valuations. This period was marked by exorbitant spending on content by streaming services, escalating costs. At the same time, ARPUs and subscription prices were kept low to attract more subscribers – an unsustainable model.

However, with the Fed’s pivot to raising interest rates in 2022, Wall Street's focus shifted toward profitability, swiftly penalizing those unable to demonstrate profits. Unfortunately, this change in market sentiment coincided with the merger's completion. While Zaslav has always been focused on cash flow, particularly to address the substantial debt incurred, the shift in stock market dynamics undoubtedly influenced his pivot. Moving away from the pre-merger objective of rapidly accumulating hundreds of millions of subscribers, Zaslav's approach shifted away from a subscriber-centric philosophy, as Alex Morris from The Science of Hitting aptly observed. Zaslav stated, “I don't really care what the number is. We're not in the business of trying to pick up every subscriber,” reflecting a blatant change to a more nuanced, profitability-focused approach.

Shareholders saw the pain when it was evident that the target of $15 billion in DTC revenues by EOY 2023 was unachievable. The silver lining, however, is that Zaslav and his team have arguably positioned the business for a higher quality of earnings when that subscriber growth picks up again. Management has transformed the business into one that should achieve operating leverage with fewer subscribers. Despite flat sub-growth YoY and a mere 6% Global ARPU increase, the business went from a $2.5 billion TTM EBITDA loss in Q3 2022 to nearly break even (-$59 million). This swing toward profitability was also accomplished during subscriber disruption when the company collapsed the HBO Max and Discovery+ platforms into a single product. This event was a reasonably strong headwind to growth for several reasons, including the known 4 million subscriber overlap between platforms, disengaged or confused users who realized they were no longer interested in paying for a service they do not use, and other technical and payment processing issues. Management failed to recognize or identify these short-term barriers that would at least partially contribute to the failure of WBD to meet its subscriber targets. However, it is a good sign that despite these adversities, the company has not lost subscribers YoY but has gained 4.5 million subs since Q1 2022.

Additionally, compared to the legacy HBO Max app, the user experience of the new platform is a night and day difference. Max is rated 4.9 out of 5 from 1.8 million ratings in the Apple marketplace. Compare this to HBO Max, which had the worst rating among its peers, with 2.8 stars. The new app has more diversified content, improved performance, less buffering, a smoother user interface experience, and a better recommendation algorithm for more user engagement, and it has since added live sports and news. All of which are essential to improving user engagement and churn.

Ultimately, the company was laser-focused on stability over the past year. Focusing on engineering Max, migrating users, and improving the product experience. Therefore, while it is easy for bears to point to the recent struggles in adding more subs, especially compared to peers, growth was not the focus.

Looking ahead, the prospects for DTC appear promising, especially with significant expansion plans in 2024 and 2025. Max is set to launch in Latin America in Q1 2024, followed by rollouts in the Nordics, Iberia, the Netherlands, and Central and Eastern Europe in spring. Max will enter new markets like France and Belgium in 2024 and others, including the UK, Germany, and Italy, in 2025 after the Sky deal expiration. According to the CEO, Max and its predecessors currently reach only 45% of the world’s broadband households, excluding China, Russia, and India, primarily due to existing exclusive licensing deals. While Netflix leads in streaming with 2.6x more subscribers than WBD globally, the gap is narrower in the UCAN (United States & Canada) region. Netflix has 77.32 million paid subscribers compared to WBD’s 52.6 million. This comparison isn’t apples-to-apples since Max isn’t available in Canada due to its exclusive licensing deal with Crave. Adjusting for Netflix's estimated 8 million Canadian subscribers, the domestic difference drops to about 32%, suggesting further upside in international markets.

The upcoming global expansion of Max carries the potential for significant revenue growth, with projections of ~50% incremental margins. This growth is expected to be further enhanced by the synergies resulting from the gradual discontinuation of HBO Max, although losses in wholesale subscribers will partly offset it. A key revenue driver will be the sports add-on, which features over 300 live games. With its transition to a $9.99 monthly fee in the coming months, this add-on is anticipated to generate substantial high-margin revenue. While it’s challenging to accurately predict the uptake, considering that half of streaming viewers frequently watch sports, a 10% subscription rate among domestic viewers could feasibly yield $600 million in incremental sales. Incorporating sports into the platform is also a strategic move to reduce subscriber churn. By initially offering the sports tier for free, Max has strategically accustomed users to accessing sports content on the platform, which may lead to higher retention rates once it becomes a paid feature. The effectiveness of this approach and its impact on subscriber retention are critical factors to monitor in the forthcoming quarters.

Final Thoughts

In conclusion, the future success of Warner Bros Discovery hinges on significant improvements in streaming economics and a significant slowdown in linear churn. I no longer view the company as having a sufficient moat that ensures success for many years ahead. Finding alternative monetization paths for its tentpole IP, such as micro-transactions in games, could help stabilize and grow earnings power. However, without a material uplift from these, there is a legitimate risk to the sustainability of the business's earnings, especially with the unraveling of linear operating leverage.

In my view, for WBD to succeed in the streaming age and drastically reduce churn, it is only logical that further scaling up through consolidation, joint ventures, or bundling is necessary and likely imminent. CEO David Zaslav’s recent discussions with Paramount CEO Ben Bakish about a potential acquisition underscore this point. Yet, there are concerns about the timing and feasibility of such a deal, given WBD's current financial position with $2.4 billion in cash and $45 billion in debt. Currently, a deal for all of Paramount would cost an EV of $25-30 billion, dilute shareholder value significantly, and add at least $14-$15 billion in net debt.

Despite these challenges, I see a low probability of further downside for WBD in 2024, barring a surprising negative catalyst. There are several tailwinds this year that could stabilize and even marginally increase revenue and EBITDA. Assuming no change in its multiple, which is already depressed, investors will see 20% equity growth with the current FCF yield. Given the upcoming year's growth drivers and cyclical advertising tailwinds, an increase or stabilization in earnings is likely, with each billion in operating profits adding roughly $10 billion in equity. If DTC growth accelerates and linear declines stall, coupled with decreasing interest rates, the stock could substantially rise due to the leverage. In a bull case scenario for the end of 2024, if EBIT multiples return to the historical 13x on a $9 billion EBIT and $10 billion in net debt is reduced (including $8 billion from FCF for Q4 2023 and 2024, plus a $2 billion decrease in DTLs), the market cap could soar to $73 billion ($117 EV - $44 billion net debt), equating to a 160% return. However, this outcome is far from guaranteed, and it's not a scenario to bet the house on. Thankfully for shareholders, the CEO, with millions of dollars of very out-of-the-money stock options at stake, is highly incentivized to make it happen.

AT&T received $40.5 billion in cash (debt-financed), debt securities, WarnerMedia’s retention of debt, and $42.3 billion in equity from the new entity (1.7 billion shares x $24.43 per share).

In 2021, Discovery and WarnerMedia generated $1.6 billion and $7.7 billion in DTC revenues, respectively.

Normalized EBIT aims to add back truly one-time economic costs and remove one-time sales increases when appropriate. It also reflects the effect of capitalizing and depreciating leases. Treating leases like cap ex.

Estimated Debt Payments by Quarter and Pro-Rated Savings through 2024

Q4 2023 | $2 - $2.5 billion Q4 2023 | $2-$2.5 billion x 4.6% = $93 - $116 million

Assuming $5-6 billion FCF FY 2024:

H1 2024 | $1-$1.5 billion FCF | ($1-$1.5 billion x 4.6%) / 2 = $23 - $35 million

H2 2024 | $4-$4.5 billion FCF | ($4-$4.5 billion x 4.6%) / 4 = $46 - $52 million

Total: $162 - $203 million (Range rounded in the article for simplicity)

Pre-Merger FCF Expectations

2022 (Q2-Q4): $3.5 billion in FCF = $6.1 billion Unlevered FCF - ($391 million Q1 Unlevered Discovery FCF + $500 million Estimation of Q1 Anticipated Unlevered Warner FCF) - $1.7 billion interest payments

2023: $8 billion in 2023 FCF

$5.9 billion through Q3 2023 + $2.4 billion in projected Q4 2023 FCF.