Wise: Progressing on the Economies of Scale-Shared Journey

A FY 2025 Q1 Update on the Cross-Border Payments Business

$WISE.L Valuation on Publish Date

Price Per Share: £6.65

Market Cap: £7,023 million

Enterprise Value: £6,464 millionTable of Contents

Drivers of Customer Value

Take Rates

Transfer Speeds

Reliability

Customer Reciprocation of Value

Active Customers

Cross-Border Volume and VPC

Take Rates

Customer Assets and Net Interest Income

Not Dependent on Sales & Marketing

Churn: Do Customers Need the Product?

Starting to Show Operating Leverage

Normalizing Operating Earnings

Looking at the Future

Overview

In an industry often plagued with high fees and slow transactions, Wise (WISE 0.00%↑) has taken the road less traveled. It is intensely focused on drastically reducing costs and transfer speeds within its proprietary cross-border infrastructure. While competitors prioritize maximizing take rates and monetization, Wise is augmenting its durable competitive advantage through strategic investments that reflect a customer-first approach. This strategy, integral to the company's ethos, strives to pass cost savings to customers through lower prices and investments in continuous product enhancements. At 19x normalized EBIT and a levered free cash flow yield of 4.4%, adjusted to exclude excess interest income and include share-based compensation, Wise appears undervalued for a highly profitable business that consistently grows its revenue, profits, and customer base at a rate exceeding 20% per year, with no signs of slowing down.

Don't miss my in-depth investment report on Wise!

Zigging while Others are Zagging

It is difficult for companies to differentiate themselves in the cross-border payment industry where services have largely been commoditized. However, a platform that vastly outperforms others on critical factors such as cost, speed, and reliability will capture a substantial market share. I believe Wise is the undisputed leader in this race, and it's not even close.

In my late 2023 investment report on Wise, I asserted that the company is building a formidable low-cost provider moat through its sharp focus, unwavering commitment to passing on economies of scale to customers, and consistent execution. This idiosyncratic approach will unlock years of profitable growth in an industry often characterized by short-term thinking.

For instance, analyzing call transcripts reveals that competitors focus more on boosting take rates and lifetime values (LTV) rather than prioritizing delivering maximum value to customers. The following excerpts from these transcripts illustrate this point clearly.

OFX - H2 2024

“You can see from the margin wall, we increased pricing in the book by 2 basis points. We watch the market closely and have excellent pricing engines that we can use to test price elasticity.”

Payoneer - Q4 2023

“We also intend to continue implementing changes to our pricing to better align to the customer segments we serve, to deliver improved monetization, and to drive improved share of wallet capture. We believe we have further opportunity in our pricing strategy to refine our corridor-based pricing and to better monetize FX. We continue to test various pricing models related to our significant in-network payment volume and believe this represents a meaningful opportunity.”

“The new disclosure that helps people see the power of our relationship with our customers and therefore our take rate dynamics, I think that's important for shareholders to understand, right? Our business has 2 components. An enterprise component is B, just very articulately shared the volume and take rate dynamics there, and an SMB customer business, which is about ICPs and ARPU and volume into the Payoneer account.”

Remitly - Q1 2024

“We really focus on making sure that we're improving, growing the LTV with our customers. And that's where the real value is.”

“And when we see our overall take rate with an average of an average, we continue to remain in a band that we're comfortable with. It's in the 2% to 2.5% range, which was very close to what we had sequentially last quarter as well. So no real changes.”

“I think yes, Will, it's a great question. I think the punch line answer to the take rate question is mix shift. So that's within the normal band. There's nothing that's happening from a competitive standpoint in Q1 that changed that.”

Wise’s peers are concentrated on extracting value from customers and maximizing monetization, often emphasizing their profits over delivering the best possible service and value.

Here is what Wise had to say on the Q4 conference call. Notice the difference?

Wise - H2 2024

“So the short answer is yes, you should expect the cross-currency take rate, or the cross-currency fees that we report to our customers, to go down year by year.”

“And there are times, as we saw last financial year, when costs came down, and we want to make sure it's sustainable. So sometimes, we will see slightly higher profit margins before we have the confidence to reduce. But we are targeting that margin, and that's what we expect to be the margin in the long term. And we will invest in that. By investment, we mean investing across all of the areas I laid out. We expect to have more opportunities to invest in price going forward and to really reduce those cross-currency prices for our customers because, ultimately, we see that's the number one reason why customers come to Wise.”

“All this investment leads to outcomes like this in speed and price. As I said before, the 62% instant transfer number, but what I'm also really proud of are the other two numbers on speed. 83% of transfers now go through our network in less than 1 hour, and 95% of transfers complete within a day. These are unheard-of numbers in cross-border payments. On price, we've operated at a 67 bps blended price for most of 2024, and we continue to put downward pressure on price while still remaining profitable.”

“The market leader over time will be the provider of the cheapest, fastest, and most convenient service with the broadest coverage. This will only be achieved through building the best global infrastructure. We will continue reinvesting back into growth each year over the medium term, whether it's investment into price, product, infrastructure, exceptional customer service, or marketing. Investments into price will bring down cross-currency prices and will drive long-term growth for the business.”

Lowering prices voluntarily may seem counterintuitive in a capitalist market, where businesses typically raise prices when they have enough leverage over customers. Without a competitive threat, reducing transfer costs might appear to leave profits on the table. However, Wise's strategy to lower prices isn't a sign of weakness or a tactic to desperately retain and attract new customers at the expense of margins. Instead, the business reduces prices only when it can sustainably maintain margins through incremental cost improvements from technology, infrastructure, scale, or regulatory changes. As Nick Sleep insightfully noted, for companies with economies of scale-shared philosophies like Wise, 'increased revenues begets scale savings begets lower costs begets lower prices begets increased revenues.' While price reductions may impact short-term profits, when executed correctly, they can extend the growth runway by paving the way for considerable market share gains and increasing the cost to compete for incumbents and potential entrants.

Understanding the Recent Market Reaction

On the road to building a dominant market position, Wise's investments in lowering prices may be misinterpreted by the market as pricing weakness. I believe this misperception has recently led to drawdowns in the stock price which created opportunities for long-term investors to take advantage of the market's tendency to shoot first and ask questions later.

For example, in its April Q4 trading results, Wise reported a 29% increase in active customers, a 24% rise in revenue1, and a 36% growth in income2. Despite these strong results amidst a challenging inflationary and interest rate environment, the market had an immediate negative reaction, leading to a 20% drawdown. Then just before the June FY24 update, Wise announced a change in its financial reporting, shifting focus from Adjusted EBITDA to "underlying operating income," excluding interest income beyond the first 1% from earnings.

Those closely following Wise since the Federal Reserve's post-ZIRP3 interest rate increases know that management has prepared investors for a lower net interest yield. Wise plans to return 80% of the yield above the first percentage point to customers. However, as a non-bank institution, regulatory constraints have limited its ability to achieve this goal.

In the June FY24 trading update, Wise reported results using the new "underlying operating earnings" metric, which excludes the 20% portion of the yield it retains, totaling £262.3 million compared to the reported EBIT of £501.9 million. This change likely confused traders unfamiliar with the new format. Additionally, management announced a ~5% reduction in average prices to 0.64% and provided an FY25 growth forecast of 15-20% (20-25% excluding the price decrease). This guidance did not meet market expectations, triggering a 20-point decline and disrupting a multi-year upward trend in the stock. However, the stock quickly rebounded after a robust Q1 FY25 report, which reported a 25% increase in active customers and a reacceleration in cross-border volumes, showing 17.7% YoY growth compared to 14.6% in the previous quarter.

Operating Progress Update

Let's review the key figures updated since my last report, focusing on the metrics that resonate most with customers. We'll then explore how customers, recognizing Wise's unique value proposition, have reciprocated by not only recommending the platform to others but also by increasing their engagement and cross-border flows on the platform.

Drivers of Customer Value

Take Rates

Since 2017, Wise's global take rate has decreased by 12.3%, starting from an already ultra-low level of 0.73%. This trend follows a cyclical pattern: prices drop to a new low, then slowly rise over two years before reaching another low. We are currently seeing a downward inflection after a two-year upward trend, so the recent price drops are not unexpected. This pattern aligns with Wise's ongoing efforts to expand available corridors and then work to optimize the network. Notably, the company reached a significant milestone by achieving its fifth direct connection with the launch of the direct integration into Australia's New Payments Platform (NPP) at the end of 2023. Wise is also preparing to launch a direct connection to Pix, Brazil's payment network, in the near future. These integrations are significant as they drastically reduce transaction costs. For instance, establishing a direct connection to the UK's FPS resulted in a 10x cost reduction.

Wise's take rate is impressive in its own right, but the true extent of its achievement becomes even more striking when compared to the broader cross-border market. The platform’s take rate is merely one-tenth of the global average for Money Transfer Operators (MTOs), which includes banks and other large money transfer institutions. Compared to the Digital-Only MTO index, which includes Wise and four other digital-native competitors, Wise's rates are 83% lower and well below the G20 remittance target. This comparison may actually understate the disparity, given Wise's inclusion within the index itself.

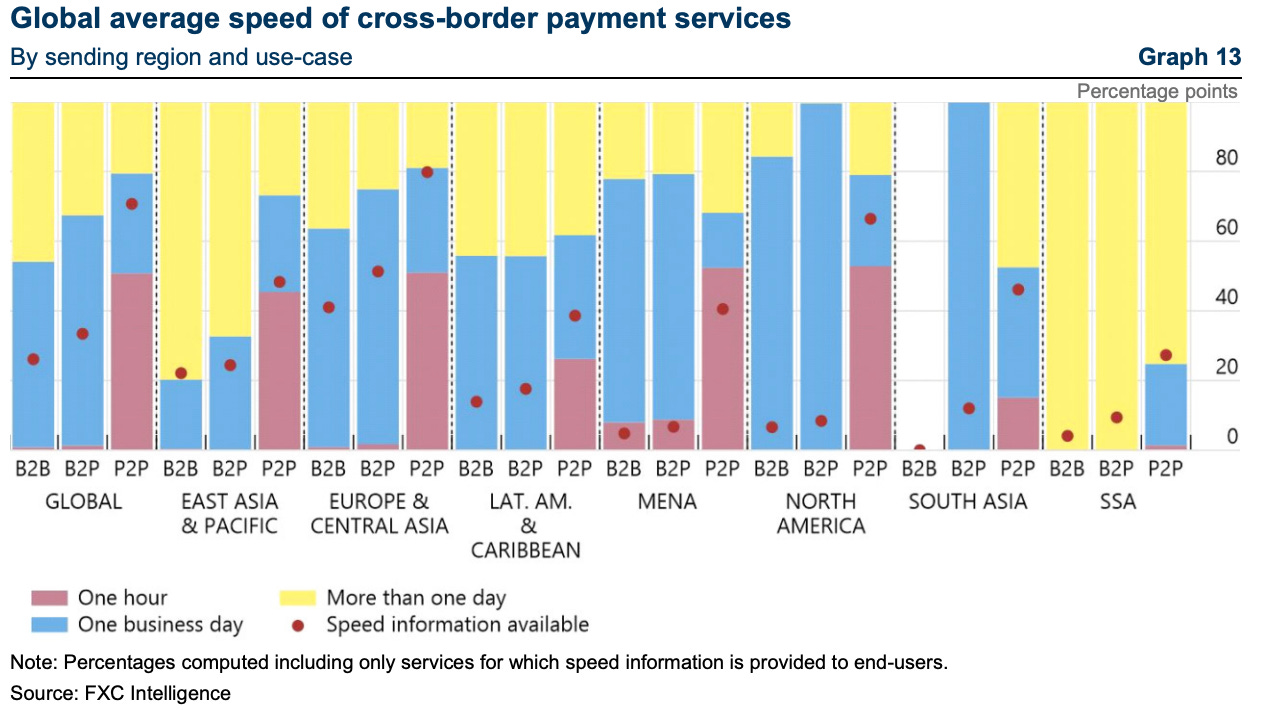

Transfer Speeds

The second major factor customers care about is transfer speed. In a world where sending money domestically via Venmo takes seconds and ordering a coffee in advance is just a click away, people are accustomed to immediate digital transactions. However, in the cross-border payments industry, major delays are common. For instance, it takes more than a day for ~46% of B2B and ~33% of B2P global transactions to process. Only about 1% of these transactions are completed in under an hour. The situation is slightly better for P2P transactions, yet still suboptimal, with ~21% taking longer than a day.

In contrast, Wise has positioned itself as a clear leader in the industry through technological and infrastructure innovations. At the end of the last fiscal year, Wise processed 62% of transfers in under 20 seconds, a significant increase from just 13% in FY 2019. Additionally, 83% of transfers are completed in under 1 hour, and 95% in under 24 hours, making multi-day processing times much less frequent compared to the industry baseline.

Reliability

Wise is investing heavily in improving the reliability and dependability of its product. Through large investments aimed at reducing friction for users—such as enhancing straight-through processing rates and leveraging automation for rapid issue resolution—the company has achieved a ~38% decline in contact rates since Q2 2023.

"So, earlier at the start of the financial year 2024, for doing checks that needed humans to review folks when we were onboarding customers, it would take on average about 13 hours. With the automated work that we've done and the investments we've made in the tooling, by the end of 2024, now for these manual checks, an average time of 2 hours is needed for these agents."

CTO Harsh Sinha | H2 2024 Conference Call

Minimizing friction is crucial because it leads to happier, more engaged customers. Additionally, fewer customer contacts allow Wise to operate more efficiently with a leaner team of customer support agents.

Customer Reciprocation of Value

My top priority before investing in a company is assessing whether it has a legitimate and expanding moat that supports growing sales and returns on capital. This analysis is often challenging, and I've made mistakes in the past by overestimating a company's competitive advantage. Consistent top and bottom-line growth and high ROICs are important, but if there's intense competition from direct competitors or substitutes, these advantages may not last. From my experience, major red flags of a 'moat trap' include high churn rates and excessive marketing expenditures as a % of revenue or aggressive discounting. These factors indicate a lack of customer loyalty, often leading to a 'race to the bottom' scenario and tough competition.

In contrast, the data for Wise indicates that customers are enthusiastic about the product and frequently share their positive experiences within their social circles, organically growing the customer base. Although there is ample opportunity to improve user engagement, Wise has become more 'sticky' and appealing over time, reinforcing its status as the premier global option for cross-border transfers. Moreover, for most people around the world, there are no viable alternatives for fast and secure transfers; the billions in daily cryptocurrency transactions pale in comparison to the trillions traded daily in fiat currencies not to mention the lack of worldwide merchant acceptance. Nonetheless, crypto is an evolving trend that should not be taken lightly and warrants close attention.

Active Customers

Active customer growth is critical for several reasons. Firstly, it is a primary driver of revenue growth. Secondly, it reflects the product's growing appeal across diverse customer segments and markets. Clearly, Wise is excelling in this area, with active customers expanding at a 31% CAGR since 2019 and 29.4% YoY, indicating robust growth even in a challenging economic environment. Wise's model thrives not only in prosperous times but also during economic downturns, as people seek cheaper options amid rising living costs.

Cross-Border Volume and VPC

From FY 2019 to FY 2023, Volume Per Customer (VPC) at Wise grew significantly from £8.2k to £10.5k. This contributed to a rapid increase in overall volumes, achieving a 40% CAGR, which outpaced customer growth by 9 percentage points. This growth in VPC was driven by higher transaction values spurred on by easy money policies and increased wallet share due to the platform's growing attractiveness. During the pandemic, government policies, including trillions in printed money and low interest rates under ZIRP, encouraged heavy spending. McKinsey reports that global payment revenue growth accelerated from 5% annually pre-pandemic to 11% between 2021 and 2022.

Wise made substantial investments in their product offerings, particularly in the Wise Account, which has significantly enhanced customer retention and increased transaction volumes. According to management, account users send 2x the volume compared to cross-border-only users. This surge in account adoption, with 36% of personal users and 55% of businesses using the Wise Account in FY2023—up from just 15% in 2021—contributed significantly to the growing VPC, as these customers typically engage more with the platform.

However, the powerful tailwinds that once drove growth became headwinds as governments shifted tighter policy measures and raised interest rates swiftly to combat inflation. According to management, the growth rate of high-value transactions and the number of users with a VPC over £10k slowed significantly, corresponding with the policy pivot.

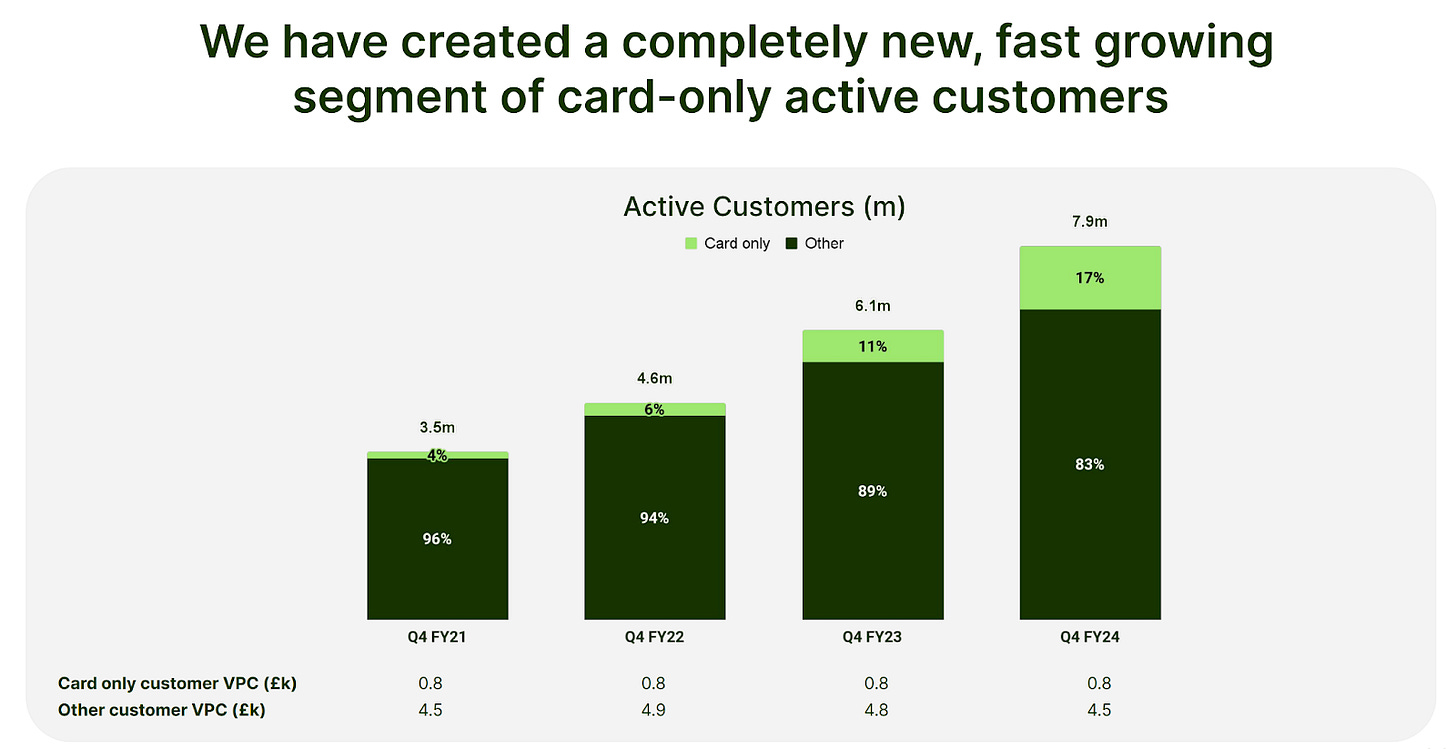

Simultaneously, there has been a mix-shift towards card-only users, who now make up 17% of total active customers, up from just 4% in 2021. These users typically have 1/6 the volume of other customers. Excluding these lower volume users, VPC would have been 15% higher in Q4 2024. It will be crucial for the company to convert these card-only customers into multi-feature users to increase wallet share and enhance brand loyalty.

As a result of the VPC weakness, despite the high growth in active users, volume growth was only 13.3% YoY. However, as prices across a wider range of corridors decrease and the economy improves, VPC should resume its climb, providing extra torque to volume.

Furthermore, significant untapped potential remains in Wise's Business and Platform segments. Currently, Wise captures less than 1% of small and midsized business (SMB) cross-border flows, serving 630k SMBs and 85 Platform partners. With business users generating 7.1x the volume as individual customers, Wise has a significant opportunity to increase VPC. Although Wise encountered operational capacity bottlenecks in FY2024, temporarily halting the onboarding of new business customers in the UK and EU, the company has since resumed onboarding across all major markets. This resolution paves the way for accelerated growth of business users.

“For Wise Platform, first of all, we are excited that we now have 85 partners globally who think what we've built over the last 13 years can be used for their customers. This is a testament to what we've invested in over the long term. I can tell you, even 4 or 5 years ago when we went to the banks, they weren't sure. Now, they are seeing that change because their customers are moving to Wise, and they are figuring out how to retain these customers in their own experience.”

CTO Harsh Sinha | H2 2024 Conference Call

The integration of Swift Correspondent Services on the Wise Platform, launched in Q2 2024, could be a significant growth catalyst. This development may enable Wise to attract larger customers, including multinational banks and financial institutions that are currently entrenched in the legacy correspondent banking system. Although the Wise Platform had gained traction with its proprietary API-focused integration, attracting significant customers like Google Pay and Interactive Brokers, it has not yet secured many established 'blue chip' financial institutions.

Management recognized from discussions with potential clients that high switching costs make it extremely difficult, time-consuming, and expensive for large financial institutions to migrate to a new platform. However, with the launch of Swift Correspondent Services, these institutions can reroute their flows with a simple 'configuration change', effectively lowering the barriers. This ease of integration could appeal to many of the 11,500 institutions across 200+ countries using Swift. As more individuals and institutions transition to Wise, attracted by the superior and more cost-effective cross-border experience, large financial institutions will feel compelled to transition as well. Driven by customer churn and competitive pressures, this shift will incentivize these institutions to adopt Wise's platform, even at the cost of forfeiting lucrative cross-border revenue streams.

Take Rates

While Wise actively works to reduce cross-border take rates, it has also expanded its card business, leading to an increase in the overall take rate through 'Other income.' This category includes fees from card spending, cash withdrawals, and ATM usage. As previously noted, there has been a surge in customer card usage in recent years. This is an excellent indicator, showing that the success and appeal of the core business may facilitate the introduction of additional value-added services, potentially offsetting the decline in cross-border take rates.

Customer Assets and Net Interest Income

Meanwhile, interest-bearing deposits have risen to £14.1 billion, growing faster than active customers. This suggests that, despite a recent decline in VPC, customers are increasingly choosing to store a greater portion of their assets in their Wise Accounts. This trend highlights the attractiveness of Wise's multi-currency account interest rates (4.95% USD, 3.32% GBP, and 2.12% EUR) compared to traditional banks, which typically offer much lower savings deposit rates, around 0.45% to 0.66%, and money market funds.

With Wise increasing the percentage of net yield passed on to customers, deposit growth should continue, barring a return to near-zero interest rates. This dynamic has proven lucrative, with quarterly net interest income reaching £107.2 million, or £429 million annually. However, reported net interest yield growth may stall or decline in the coming years, as the Federal Reserve signals potential rate cuts and the ECB already started reducing rates in June.

Another critical driver of future net interest is Wise's strategy to reduce its interest yield take rates, thereby redistributing more cash to depositors. Management has stated its intention to retain the first percentage point plus 20% of the remaining yield, passing on the remaining yield to consumers. This strategy prompted management to shift investor focus to underlying income metrics, providing a more normalized view of operating earnings that isn't skewed by excess interest income.

The blue line in the chart above indicates the normalized interest rate if Wise successfully returns 80% of the remaining yield to customers. For instance, if the gross interest rate stabilizes around 3.5% after rate cuts, Wise's retained net interest yield would be 1.5%4, down from 3.13% today. To maintain the current level of total reported net interest income, customer assets would need to more than double. Consequently, it may take some time for interest income to grow again, making it crucial to focus on normalized earnings to understand the true earning potential. Given the global fragmented and restrictive regulatory environment, it could take many years to distribute the full 80% to customers. Therefore, if customers continue to grow fast, deposit growth may completely offset the decline in net yield over the next five years.

Not Dependent on Sales & Marketing

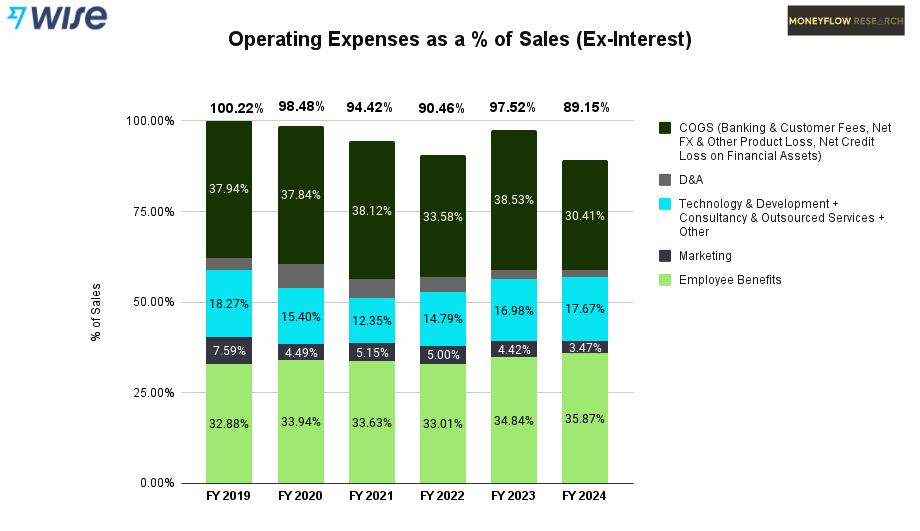

Consistent 30% YoY growth is impressive, but it's less meaningful if a company spends heavily to retain and acquire customers. How are new customers discovering Wise? Is it through expensive global marketing campaigns? Surprisingly, no. Wise allocates just 3.47% of its sales to marketing, down from 7.59% in 2019. Remarkably, two-thirds of new customers come from word of mouth. While this claim might typically be met with skepticism, the abundance of positive online reviews and consistent growth despite a modest marketing budget support its validity. This organic growth strategy not only builds a loyal customer base but also enables Wise to reinvest capital into strengthening and expanding its durable competitive advantages.

Churn: Do Customers Need the Product?

In the FY 2024 results presentation, management shared the quarterly volume by cohort. The graph illustrates that each cohort’s volume peaks after about a year, then slightly decreases before stabilizing. This stability, achieved with minimal marketing to remind customers to stay engaged, underscores the inherent value of the platform to customers. Ideally, future cohort trends would show consistent growth in volume over time. However, some of the observed fluctuations might be attributable to volume churn noise, particularly in the aftermath of the COVID era.

As shown by the graph above, although it is declining rapidly, Wise does experience a material level of customer churn5 each year. Management attributes most of the churn primarily to customers no longer needing to send money across borders.

“I think you asked the question of why people leave Wise. The primary reason someone would stop using Wise is that the use case goes away. So it would really be because maybe you're funding one of your kids overseas at university, they're going to come back at some point. Now they might take out a loan and continue to be the customer themselves.”

Former CFO Matthew Briers | Q4 2023 Trading Call

Given that most active customers are retail users, it's understandable that many don't consistently need to transfer money internationally. For example, I used the Wise app to send money to my sister in the UK several months ago, but since I don't often need to send money across borders, I haven't needed to use it since. Many people, like myself, seek the best and cheapest product but don't have a recurring need for it.

This explanation is supported by the high customer satisfaction, as evidenced by the strong word-of-mouth virality. However, I remain cautious, as customers of these platforms do shop around for the cheapest options when looking to send money. While Wise is generally lower-cost than other providers, it isn't always the cheapest for every corridor, especially where it lacks a direct connection to local payment networks.

On a positive note, the churn rate has decreased by 26.4% in a few short years, which is a meaningful improvement. While I would like to see it reduced to below 5-10%, achieving this will take time. However, I believe Wise can reach this goal over the next decade.

Starting to Show Operating Leverage

In my original research report, I addressed a bear case that questions whether Wise can achieve operating leverage in its model. From FY 2019 through FY 2022, the outlook seemed positive. However, in FY 2023, operating expenses rebounded, and operating margins on sales (ex-interest) shrunk. In FY 2024, the situation improved significantly, with the company achieving its highest cross-border product operating margin in history. Interestingly, this was accomplished without a reduction in employee benefits as a % of sales, which leaves plenty of room for further operating leverage gains.

The persistence of high employee benefits has been largely due to growth in operating expenditures aimed at capturing more market share and seizing incremental revenue opportunities. As cross-border volumes approach a critical mass, Wise should be able to handle increased volume without a corresponding increase in payroll. While there were minor improvements of around 1% each in Sales & Marketing (S&M) and Depreciation & Amortization (D&A), the majority of the operating leverage came from a reduction in COGS, which decreased by 8 percentage points to 30.41%. The key question now is whether this improvement in COGS is sustainable.

Wise's COGS comprises three main components: banking & customer fees, net credit losses on financial assets, and FX loss & other product costs. FX losses typically correlate with market volatility. In 2022, global FX volatility spiked, leading to increased FX and other product costs in the 2023 fiscal year. While recent stability in FX markets drove a 450 bps improvement in COGS, management considers this reduction an anomaly rather than a sustainable trend. However, some gains are attributed to structural improvements, such as enhanced controls that reduced account-related costs like chargebacks and overdrawn balances. As FX volatility normalizes and price reductions are implemented, I expect this cost to settle between 6-7%.

Net credit losses, which have ranged between 0.4% and 2%, are a regular business expense, akin to shrinkage in retail, and are largely unavoidable. Based on historical trends, a 1-2% expense is a reasonable expectation for the foreseeable future.

Banking and customer-related fees, which include costs for moving money, are higher in regions where Wise lacks a direct network connection and also cover charges from financial institutions and payment processors, as well as customer account management and transaction processing. While there were some operational efficiencies achieved last fiscal year due to infrastructure improvements, price reductions in the coming years will cause mean reversion. As such, normalizing this number to a 26-28% range seems prudent. Overall, when summing up the individual estimates for banking & customer fees, net credit losses, and FX loss & other product costs, COGS as a percentage of product sales is likely to stabilize in the normalized range of 33% - 37%.

Wise is Undervalued

Despite recent market concerns over Wise's declining take rate and strategic investments that temporarily impact profitability, the business continues to expand its earnings power and strengthen its competitive position. This is evidenced by increasing returns on capital, consistent customer growth, stable cohort volumes over time, growing transaction volumes, and improving operating leverage. In my experience, when a company has a deepening moat while short-term challenges cause its share price to stall, the stock often behaves like a coiled spring. Eventually, the market recognizes the company's inherent value, leading to a sharp appreciation in the stock price, often to unexpectedly high multiples.

Normalizing Operating Earnings

First, let’s examine the earnings power of Wise. Currently, the business is overearning, reporting £495 million in operating income for FY 2024, of which £360 million is interest income. This represents a net yield of 3% on a 4.04% gross yield, with last quarter's rate being 4.34%. Adjusting the forward-looking gross yield to a more conservative 3%, the net yield translates to 1.4% or £168 million, based on the Wise interest framework.

In addition to interest income, there are growth-oriented operating expenditures aimed at increasing market share, which are not essential for maintaining current profit levels. It’s crucial to exercise caution when adding back operating expenses since, for many businesses, increased expenditures are necessary just to maintain competitive positioning. Understanding the specifics of growth spend or capital expenditures can be challenging without explicit figures from management. However, based on my understanding of the business, Wise is investing significantly to expand its market share. For instance, if the company were to cease investing in future growth initiatives, its operating leverage and profits would substantially increase over the next few years, though this would likely negatively impact mid to long-term growth. I estimate that the company has spent at least £60 million on growth, approximately 50% of the incremental op-ex from FY23, or under 10% of total operating expenses in FY 2024.

These adjustments result in a normalized EBITDA of £363 million after subtracting £132 million (£192 million6 - £60 million7). The business also spent £20 million in cap-ex, which I consider entirely maintenance, leading to a total normalized EBIT of £343 million, which means the enterprise is selling for just over 19x EBIT. Levered cash flow, after similar adjustments including subtracting share-based compensation (SBC), amounts to approximately £316.50 million, resulting in a cash flow yield of 4.4%. I consider this an outstanding yield for a highly profitable business that continues to grow quality revenue streams by 20%-30% annually, even in economically challenging times.

Looking at the Future

Next, let's consider the future prospects for Wise. I want to caution readers that, as Warren Buffett famously advised, it’s better to be roughly right than precisely wrong when appraising a business. Experience has taught me that even the most carefully crafted long-term projections are seldom accurate. However, it is crucial to run through this exercise to conceptually map out what the growth trajectory might look like. The good news is that I don’t have to be exactly right to win big, as long as my analysis is correct in identifying Wise as a durable compounder.

Given my thesis that a material portion of cross-border flows will shift to Wise as it achieves a sufficiently low take rate across a broader range of corridors, Wise should be able to capture at least a 10% share of the personal market and a 3% share of the business market in a decade. These projections are achievable with Wise holding 5% of the personal market and just under 1% of the business/SMB market today.

Predicting the take rate a decade from now is inherently challenging, as accurate forecasting is difficult. However, Wise has been actively working to reduce cross-border transaction rates and has successfully lowered these rates by 12% over the past 7 years. It's important to note that as take rates approach 0, achieving further reductions in average rates will likely become more challenging. At the same time, there are opportunities to increase 'Other Income' through ancillary revenue streams. While a 0.75% take rate might be overly conservative, it's better to err on the side of caution.

The company currently boasts product-level gross margins of ~70% and 11% operating margins. Over time, it is expected to benefit from significant operating leverage as employee costs decrease relative to revenue, allowing gross profits from incremental volumes to flow directly to the operating income line. For comparison, Western Union (WU 0.00%↑), despite having a lower gross margin of just under 40% and a relatively inefficient cost structure, maintains a 20% operating margin in its mature stage. Therefore, achieving a 20% operating margin is a reasonable target for Wise, potentially translating to around £1 billion in EBIT on £4.7 billion in total income.

Regarding net interest, I anticipate that in 10 years, customer balances will constitute a higher percentage of total volumes than the current 11.4%, with Wise’s plan to distribute a large % of interest to customers compared to what traditional banks offer. However, for the sake of conservatism, I'm unwilling to estimate this percentage higher than 12%. Predicting future interest rates is challenging. Historically, the average has been 5.42% since 1971, but I'm estimating a range of 3.5% to 4%. While the average rate over the past decade has been under 2%, I believe that ultra-low interest rates are unlikely to persist, given the record-high interest on U.S. debt and increasing U.S. budget deficits, which may necessitate the continuation of money printing.

With a 3% gross yield under the Wise Net Interest Framework, the business would generate a net interest margin of 1.4%, translating to approximately £950 million per year. Net Interest is somewhat insulated from fluctuations, as Wise retains the first percentage point unless gross interest rates drop below 1%. For instance, with a 2% gross interest rate, Wise’s net yield would decrease to only 1.2%, translating to a £150 million reduction in annual interest income on ~£76 billion in customer assets.

I applied a 20x multiple to the valuation of cross-border related cash flows, which is modest for a capital-light business still growing cash flow at double-digit rates. For the more cyclical interest income, I used a lower 10x multiple, though secular growth in customer balances could mitigate some of this cyclicality. The result is an enterprise value of nearly £30 billion, with a blended multiple of approximately 15x, compared to the current value of £6.5 billion and a net cash position.

Conclusion

Wise's unique approach of prioritizing customer value over short-term profits sets it apart in the competitive cross-border payments industry. The company's relentless focus on lowering costs, increasing speed, and enhancing reliability has fostered a loyal customer base and organic growth. While the recent market reaction might have been driven by misconceptions about Wise's strategic investments, the company's strong underlying performance, evident in its customer growth, consistent volume increases in a weak global economy, and improving margins, indicates a robust future. With ongoing infrastructure enhancements, expansion into new markets, and a focus on operational efficiency, Wise is well-positioned to grow its free cash flow for years to come. The company's commitment to passing on savings to customers and maintaining a high-quality service level not only strengthens its competitive moat but also sets a new benchmark for the industry. Shareholders who recognize the long-term potential of Wise's customer-centric and economies of scale-shared strategy are likely to be rewarded handsomely.

Revenue = Cross Border Revenue + Other Income (Mostly Card Interchange and Account Fees)

Income = Revenue + Net Interest

Zero Interest-Rate Policy

Remaining Yield After First Percentage: 3.5% - 1% = 2.5%.

Remainder That Flows to Earnings: 20% x 2.5% = 0.5%.

Total Wise Framework Net Interest Yield: 1% + 0.5% = 1.5%

Churn Rate = [(Customersₜ₋₁ + New Customers - Customersₜ) / Customersₜ₋₁] x 100

£360 million net interest income - £168 million at 1.4% normalized net yield

My estimate of growth operating expenditures

Hey Mike, I began studying Remitly vs. WISE this weekend. After 3-4 hours in I came across this writeup and thought it was phenomenal. Mind if I DM you to chat? Cheers.

Great article. Thanks for sharing!