LON:$WISE Valuation on Publish Date

Price Per Share: £6.78

Market Cap: £6,947 million

Enterprise Value: £6,540 millionLatest Update on Wise:

After exploring this deep-dive report, be sure to read the August 2024 follow-up article for the most recent insights on Wise.

Outline

Executive Overview

A Global-First Money Account

Wise Transfer

Wise Account

Wise Business

Wise Platform

The Cross-Border Payments Industry

Race to the Bottom: The Challenge of Differentiation in Cross-Border Money Transfers

Barriers to Entry in Cross-Border Payments

Wise's Market Position and Growth Trajectory

Moat Analysis: A Wise & Durable Competitive Advantage

The Correspondent Banking Problem

Mission Zero: The Path to Unlocking a Golden Opportunity

Building a Low-Cost Fortress

Shared Economies of Scale: Building a Defensible Moat

Management & Culture

Capital Allocation

Compensation & Equity Ownership

Inverting the Thesis: Addressing the Main Risks

Intense Competitive Threats

Potential Substitutionary Threats: The Risks of Evolving Multi-Lateral Payment Systems and Digital Currencies

Where is the Operating Leverage?

Valuation

Conclusion

Executive Overview

Wise, formerly known as TransferWise, is a fintech company disrupting the £11+ trillion cross-border payment market1 with its dedication to low costs, lightning transfer speeds, and transparency. Founded with a vision to make international money transfers more affordable and straightforward, Wise's primary mission, "Mission Zero", aims to drive the costs of these transfers down to zero. This is achieved by circumventing the traditional, fee-heavy banking system, and establishing a global network of local bank accounts and direct payment connections to real-time domestic schemes, eliminating intermediaries and the requirement for money to actually cross borders. This strategy not only counter-positions Wise as a customer-first option in an industry often characterized by hidden fees but also creates significant barriers to entry for potential competitors who cannot sustainably match its costs, solidifying Wise's durable competitive advantage.

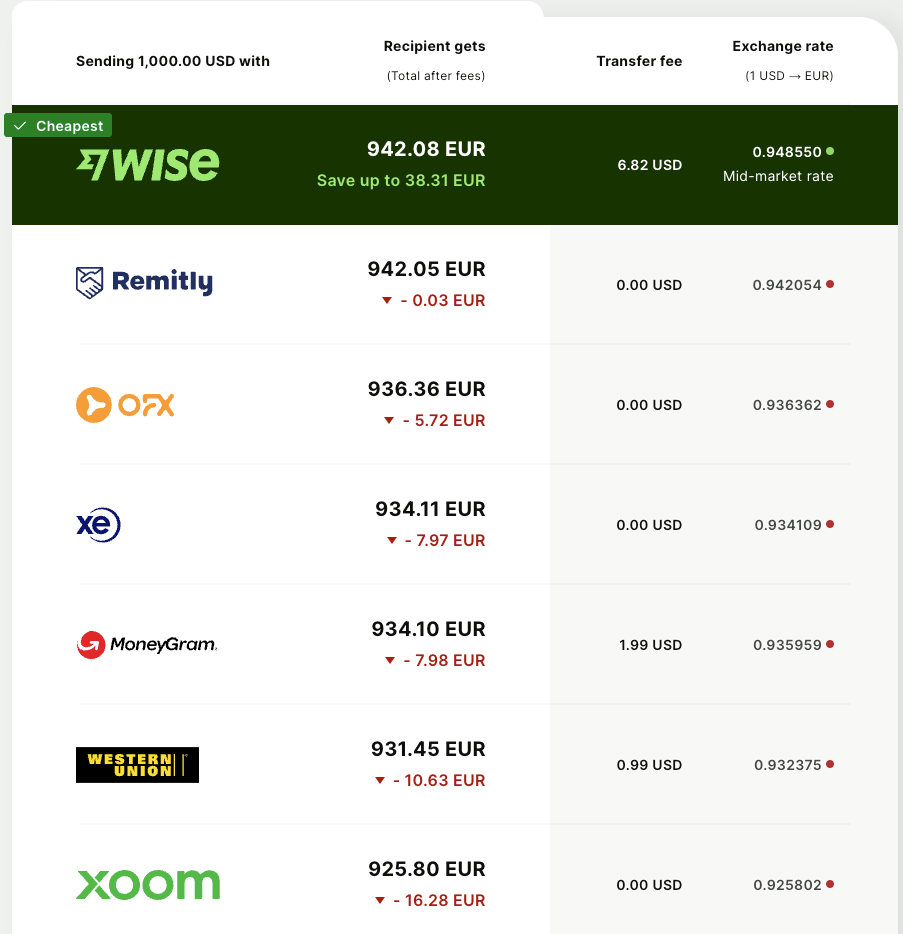

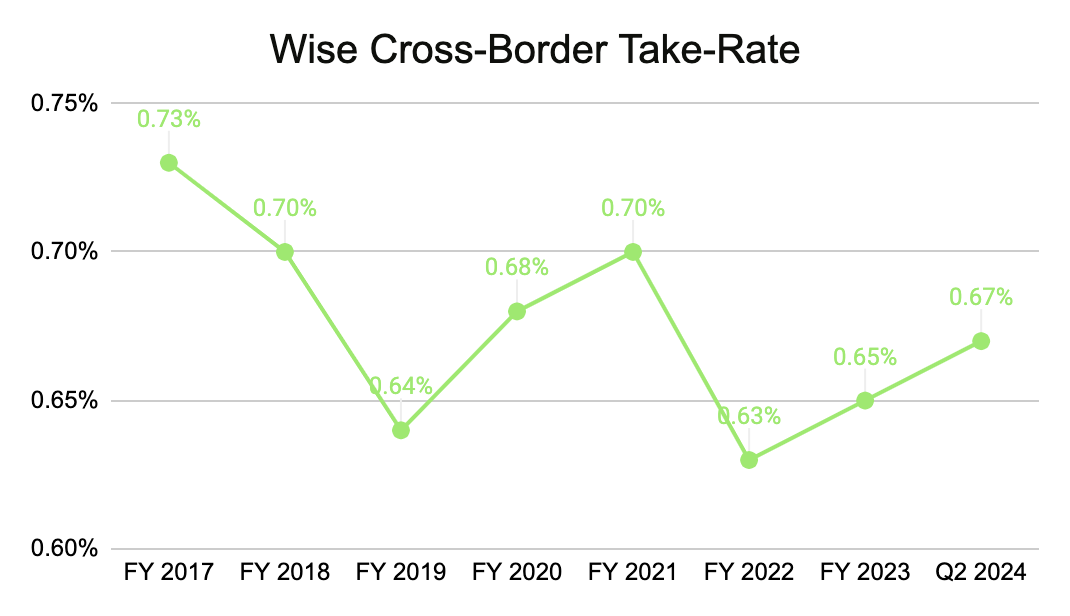

Wise boasts a durable competitive edge rooted in its specialized global payments infrastructure and commitment to shared economies of scale. This has fueled remarkable growth, with volumes expanding over 4x since 2019. Wise’s take rate of 0.67% is structurally lower than competitors by 5-10x, underscoring its unmatched cost position.

In my view, Wise could generate over £1.7 billion in EBIT by 2033, stemming from £950 million in volume-based operating income and £750 million in net interest. With persistent compound growth of over 20%, a 15x EBIT multiple is realistic, equating to a £25.5 billion valuation.

Additionally, Wise’s earnings yield should reach ~5% in FY 2024, providing a compelling value proposition for investors. If key inputs turn out favorably, EBIT could approach £3 billion, making the shares undervalued today. While uncertainties exist, Wise’s focused strategy, rock-solid management, and dominating infrastructure provide a wide margin of safety, positioning it for significant long-term growth potential.

A Global-First Money Account

Wise offers its customers a one-stop shop for moving, managing, and spending money globally. Unlike traditional banking systems, which were architected to facilitate transfers within their own networks without prioritizing efficiency for cross-border transactions, Wise was purposefully designed from its inception as an optimized platform for international transfers.

Established with the vision of making international money transfers fair and straightforward, Wise has grown far beyond its initial remit. Wise's product ecosystem, including the Wise Account, Wise Business, and Wise Platform, caters to a global audience with diverse financial needs. Each offering is a testament to Wise's commitment to low fees, speed, transparency, and an exceptional user experience, empowering customers to navigate the global economy effortlessly.

Wise Transfer

Wise Transfer remains the cornerstone of the company's offerings, enabling users to send money across borders quickly at a low cost. Charging only a nominal flat fee and a small % of the transaction amount, Wise sets itself apart by offering customers the mid-market FX exchange rate, which is the most favorable rate available in the market. This approach eliminates the sneaky FX markups that are standard among other institutions.

The entire payment flow on Wise is specifically designed to be transparent every step of the way. This includes initiating the payment, conducting the necessary verification checks, and managing the conversion process and the final payout. Users are fully informed about the exact amount they are sending, what the recipient will receive, and the total fees involved, fostering trust and reliability in every transaction.

As part of this commitment to transparency, Wise provides a user-friendly comparison tool that empowers customers to compare fees with those of competitors across all available currency routes—even when Wise may not be the most economical option.2

The business has experienced a remarkable growth in customer transfer volume, which has quadrupled since 2019. This surge is primarily driven by a more than a 3x increase in active customers and partially due to a ~17% rise in Volume per Customer (VPC).

Wise Account

The Wise Account is designed for those who work, travel, or live internationally, serving as a global multi-currency bank account, all within one unified platform. This account allows users to hold over 50 currencies across 160 countries and enables users to obtain international bank details in 9 countries, meaning customers can pay and get paid like a local, receiving money in those locales without cross-border fees. This feature is particularly beneficial for freelancers, expats, and businesses, making this product a compelling reason for those needing to transact globally.

Wise Debit Card

The Wise Debit Card is a physical manifestation of the Wise Account, allowing users to spend money internationally at the real exchange rate with no FX markups or hidden fees. Its distinctiveness lies in its intelligent currency conversion feature: when a customer utilizes the card internationally and lacks the requisite currency balance, the account automatically sources the funds from the available currency with the cheapest conversion fee.

Wise’s take rate, sales generated as a % of the total transaction volume, has undergone a significant shift. While the cross-currency take rate has remained relatively stable, fluctuating between .63% and .70%, there's been a pronounced increase in the overall take rate, climbing from .66% in FY 2019 to .86% TTM (ending Q2 2024). This increase is predominately due to an uptick in 'other income,' which includes fees from the debit card launched in 2018, as well as fees from card spending, cash withdrawals, and ATM usage.

Wise Interest/Stocks

In tandem with the surging global interest rates, Wise launched its interest product at the end of 2022, a feature that offers customers interest on deposits close to central bank rates. This offering not only enhances the appeal of maintaining multi-currency balances on the platform but also elevates Wise as a comprehensive solution for global financial management. Customers gain a dual benefit: competitive returns on their deposits and a low-risk investment strategy, as funds are funneled into government-backed short-term securities via BlackRock funds, offering a secure and lucrative alternative to traditional savings avenues. Additionally, the company gives customers in select regions an option to invest in stocks through the iShares World Equity Index Fund, featuring a basket portfolio of many of the world's leading companies.

This product serves as a reinforcement for Wise, bolstering the platform’s value, augmenting user engagement, and fostering the retention of higher account balances—all crucial for the platform's growth trajectory. Notably, Wise operates with a customer-centric ethos, targeting an 80% pass-through rate of the company's interest income back to the customers. The company seeks to do this by offering competitive interest rates, minimizing fees, or rolling out customer account incentives. However, as of the latest quarter, the business has only managed to redistribute 25% of the gross 3.88% interest yield on customer deposits due to regulatory hurdles in various countries.3

Wise didn't initially set out to build out features other than transfers. The business is not building Wise Account features mainly as a customer acquisition tool or as a way to create a new revenue stream (although that is a major benefit), but rather as a way to bolster the low-cost value proposition of its core product.

“There's lots of businesses around the world that are -- that have a customer base, and they trying monetize that customer base as much as they can with different products. They see which ones fit which ones don't.

For us, I'd say it's the other way around, like we have a core business that we do really, really well, which is helping people manage and move their money around the world. So the question is, what can we build from a product perspective to help them do that better, get more of those people to come and use Wise, save them billions of pounds and in doing so, fund and build an amazing valuable business out of time.”

Matthew Briers, CFO

The strategy is proving effective, with users who utilize these ancillary Wise Account features exhibiting significantly higher activity, engaging in 3x the number of transactions and 2x the transaction volume relative to other users.

As transfer volume has expanded, so too have customer balances, a trend helped by the interest product and expanding interest rates. This feature not only bolstered the value proposition for customers, making it more attractive to hold money with Wise, but it also created a pathway for Wise to grow another revenue stream.

Wise Business

Wise Business specifically caters to the nuanced needs of companies engaging in international operations. This platform alleviates typical challenges faced by businesses, offering solutions such as batch payments for handling multiple transactions simultaneously, seamless integration with popular accounting tools for effortless financial tracking, and multi-user access to facilitate collaborative financial management. These features simplify various aspects of international commerce, from settling invoices with overseas suppliers to remunerating international staff, thereby eliminating the traditional hurdles of cross-border transactions.

This offering not only benefits its business customers by significantly cutting down the costs and intricacies of global payments but also strategically positions Wise to tap into the broader SMB market. While the transaction fees in this segment are not as prohibitive as those commonly charged to individual consumers, they still hover around an average of 1.65%. This presents a substantial opportunity for Wise to intervene and offer a more cost-effective alternative. With £9 trillion in total market volume, Wise's competitive pricing strategy is particularly appealing to SMBs, allowing entities ranging from fledgling startups to established corporations to leverage Wise Business for efficient, cost-effective international financial operations. The strategy has thus far proved effective, as active business users grew over 4x from FY 2019 to 2023, growing from 120k to 520k.

Wise Platform

The Wise Platform enables a diverse range of partners—including traditional banks, neobanks, digital wallets, payment platforms, and any business endeavoring to offer cross-border payments—to leverage Wise’s infrastructure through a simple API integration. This integration facilitates the extension of Wise network benefits to customers directly within partners' own applications, without requiring users to transition away from their trusted platforms.

This strategic product serves as a lifeline for banks witnessing a steady exodus of customers seeking cheaper and more progressive financial solutions. By collaborating with Wise, these institutions can retain and even expand their customer base, offering state-of-the-art international transaction capabilities that many customers would otherwise turn to fintech alternatives to find.

For Wise, the benefits of this approach are manifold: it dramatically extends the reach of its services and provides access to a vast pool of potential users. By embedding its technology within a diverse array of financial ecosystems, Wise doesn't just increase its market penetration but also establishes itself as an invaluable partner to banking institutions across the globe.

The Cross-Border Payments Industry

The cross-border payments industry is ruthlessly competitive and fragmented. It is composed of banks, fintechs, neo-banks, card networks, traditional money transfer operators (MTOs), and governmental organizations. Furthermore, the market is highly segmented by various end-user needs such as business payments, consumer payments, e-commerce, cash remittance, investments, governments, AR/AP, large multinational corporations, and many others with lots of overlap amongst players.

Race to the Bottom: The Challenge of Differentiation in Cross-Border Money Transfers

Cross-border money transfer—transferring funds from one country to another—is a commoditized business. There is a very limited number of ways for firms to differentiate as consumers mainly care about their funds moving quickly in a cost-effective and frictionless way. The correspondent banking system, where multiple intermediary banks facilitate international transfers between the originating and receiving banks, has historically been the backbone of these transactions. However, this system often leads to inconvenient delays and a barrage of opaque fees. Historically, banks and remittance-focused traditional Money Transfer Operators (MTOs) such as Western Union, MoneyGram, and Ria provided a slow money transfer experience at a very high cost with little incentive to improve it. This system permitted these institutions to function like toll booths, imposing hefty fees on retail transactions in the absence of legitimate alternatives.

With the dawn of the 2010s came a wave of cutting-edge, digital-first fintech firms, offering consumers broader, cross-border financial alternatives. Driven by venture capital, these emerging entities dove into the vast, multi-trillion-dollar market, amplifying competition and the costs of distinctiveness in this fast-paced arena. Companies were left with a choice: aggressively compete through pricing and enhanced features or persist in exploiting less informed customers, a long-standing practice among banks and traditional MTOs.

Despite intensifying competition, the core issue of the antiquated correspondent banking system remained unaddressed, with many fintechs still dependent on this legacy framework. The burgeoning digital entrants exert a downward pull on take rates. To differentiate, fintechs and banks are compelled to either cut prices—without lowering service costs—or ramp up investment in value-added services, triggering a relentless expenditure cycle without matching returns. This scenario has prompted warnings from executives at prominent banks, including Santander Bank, raising concerns about the vulnerability of their cash cow profits.

In this rapidly evolving landscape, becoming the market leader necessitates becoming the low-cost producer, achieving a structural cost and speed advantage through innovation, adaptability, and bypassing the inefficiencies of the legacy correspondent banking system. This enables the delivery of fast, affordable, and transparent services. Ascension to the forefront as the principal low-cost producer requires eliminating the costly intermediaries and establishing a large proprietary infrastructure of direct payment connections. However, this endeavor is fraught with substantial barriers to entry and complexities, including navigating a sea of regulations, fragmented data standards, localization, lack of direct payment connection accessibility, and the costs of maintaining a global network.

Barriers to Entry in Cross-Border Payments

Fragmented Regulatory and Data Standards

There is no one-size-fits-all approach to cross-border payments. Regulations across jurisdictions vary greatly and licenses are necessary to operate in most countries. The process of acquiring licenses around the world is time-consuming, costly, and complex. The fun doesn’t stop there when the license is acquired. Subsequently, the company must deal with idiosyncratic banking and financial compliance measures for each region. For example, there is a laundry list of standards that the company must ensure 100% compliance when facilitating payments. This includes various transaction integrity checks such as Anti-Money Laundering (AML), Know-your-Customer (KYC), and Combatting the Financing of Terrorism (CFT). Complying with each country’s rules involves expensive professional legal help from advisory and consultancy services. Thereafter, the product engineering team needs to build software flexible enough to meet a wide variety of requirements. These internal procedures then need to be adaptable for change as jurisdictions may amend regulations sporadically. Managing these items for one or a handful of regions may not be particularly difficult. However, scaling this up by dozens or even hundreds is where the task becomes prohibitive for many firms. The consequences of failing to comply are expensive. For example, MoneyGram’s compliance failure to crack down on fraudulent money transfers in 2012 resulted in a $125 million fine. Wise itself was fined $360k by Abu Dhabi over failures in its AML controls.

Expectations for data transmission formats across payment rails are also complex and disjointed, making comprehensive automation an uphill battle. Payment messages sent between financial institutions must meet the standards of local laws. Due to the disparate standards and legacy data formats, payment data that is processed in one region may truncate or omit data that is critical for compliance in another. This creates unnecessary manual interventions conducted by customer service personnel that are slow and costly, making it difficult to scale up.

There is widespread acknowledgment throughout the industry and amongst governments that this is a major problem. As a result, global and regional initiatives are currently underway to eliminate the legacy data format, ISO 15022, and migrate to the new standard ISO 20022 by 2025, which provides a way to transmit a richer set of payment data and better-structured information. While there are several worldwide collaborations underway, including CBDCs, IXB, Nexus, and others, to innovate a more effective comprehensive solution, the new standard does not eliminate the underlying corresponding banking problem.

The Uphill Battle for Direct Access

In many jurisdictions, it is necessary to partner with a local financial institution (FI) such as a bank to access domestic payment networks. These banks typically have immense pricing power since they know there are not many other options, which significantly increases the costs and reduces the margins for cross-border fintechs.

“The high cost of connecting to real-time schemes to incumbent bank ‘gatekeeping’, where these banks are able to decide how much access to that infrastructure costs. “Non-banks often pay many multiples of the actual cost of a payment because banks have to make them on the non-bank’s behalf.”

Caroline Clare, Head of European Expansion at Wise

Thus, removing intermediaries is imperative to developing a sustainable cost advantage. Otherwise, the company is simply using the same infrastructure and access points as its peers. However, achieving this in most markets let alone across the world is not easy. It is not just a technical software challenge. Regulators are not keen on giving just anyone access to the payment rails. It is a learned skill for nonbank payment providers to persuade central banks and governmental bodies to grant access. There is no uniform approach for each market and typically the application onboarding process is bureaucratic, slow, and expensive. There are also large upfront costs such as deploying the technology on the ground through physical data centers, since that is often what the regulations require. As a result, many fintechs capitulate by choosing to work with a local FI to connect.

“Implementation to connect to [multiple] schemes is complicated, which meant for us the return on investment in doing so was hard to justify. As a result, we opted to use an intermediary to connect,”

Alex Reddish, Managing Director at Tribe Payments.

Establishing direct connections to domestic payment schemes is a demanding endeavor with substantial barriers to entry. For instance, the company is currently unable to directly settle transactions on the newly minted US FedNow network without a banking license. It took Wise an exhaustive five-year effort, in close collaboration with regulators, to become the first nonbank entity to connect directly to the UK Faster Payments Service (FPS) in 2018. Despite over 13 years of operation, Wise has managed to secure direct connections to only four countries' domestic payment systems, with expansions into Brazil and Australia on the horizon.

However, there is still a vast opportunity ahead. As of March 2023, 60 countries have implemented fast retail payment systems (FPS), indicating ample room for expansion. Securing direct access as a payment provider offers substantial, quantifiable advantages. For example, Wise's integration with the UK's Faster Payments Service (FPS) led to a dramatic 96% reduction in payment times and cut transaction fees from 60p to just 6p—savings that are directly passed on to customers.

Prohibitive Costs of Developing & Maintaining a Global Network

Establishing a global network for cross-border payments is an intricate and costly endeavor, rife with both fixed and variable expenses. Companies venturing into this domain face significant financial burdens from multiple fronts. Compliance with diverse regulatory standards is crucial to prevent money laundering and other criminal activity while ensuring a seamless user experience demands robust customer service. Navigating global legal frameworks requires expensive professional and legal advisories, further adding to the costs.

Managing the financial intricacies of a cross-border payments business is a multifaceted challenge. Expenses related to physical hardware, cloud services, and partnerships with financial institutions are just the tip of the iceberg. Layered on top are complexities involving foreign exchange risks, credit losses, liquidity management, and stringent capital requirements. To illustrate, consider Remitly's financials: since 2019, the company's operational expenses—excluding marketing—have amounted to $1.32 billion, consuming 89% of its total sales. When an additional $409 million in marketing and spiraling customer acquisition costs are factored in, the path to profitability becomes increasingly elusive. This highlights the substantial burden of fixed infrastructure investments, amplified by surging marketing and customer acquisition costs. In contrast, Wise operates more efficiently, with pre-marketing operating costs accounting for 85.4% of sales coupled with only ~5% in marketing costs. It's worth noting that Remitly's take rate is 3.5x higher, suggesting that the financial performance gap between the two companies could be even more pronounced than it appears if Wise decided to close the gap.

Scaling operations is crucial for companies to leverage their large fixed costs effectively, yet global expansion is riddled with hurdles. Incorporating a new country into a company's network is a complex undertaking. It demands meticulous planning, substantial resources, and a tailored approach to each region's specific technical, legal, and financial nuances. This complexity is magnified by the requirement to navigate diverse regulatory climates, handle currency exchanges, and forge alliances with local financial institutions. Moreover, each new market brings its own challenges and costs, emphasizing the need for comprehensive strategies and strict compliance with country-specific standards. Global scaling isn't just about network expansion; it's about adeptly maneuvering through a labyrinth of regulations, partnerships, and financial obstacles, all of which introduce additional layers of intricacy and expense.

Wise's Market Position and Growth Trajectory

The U.K.-based firm is quickly becoming a problem for banks and the traditional MTOs. Even with its current market share of just 5% in the £2 trillion personal transfer segment, 0.33% in the £9 trillion SMB sector, and a slimmer slice of the £11 trillion large enterprise flows4, the company is on an upward trajectory, with user numbers escalating at a remarkable annual growth rate exceeding 30%, despite minimal spending on marketing.

In the second quarter of 2024, the business reported a seemingly mediocre 12% year-over-year growth in volume in constant currency. Drilling into the drivers of growth, the user base expanded by 32%, while experiencing a drag from an 18% reduction in VPC. Especially over a short period of time, the VPC metric is particularly sensitive to economic fluctuations. During prosperous economic periods, individuals and businesses engage in more frequent and substantial cross-border transactions, buoyed by investments and big-ticket purchases. Conversely, these activities have contracted when economic conditions including rising interest rates are less favorable, creating headwinds for growth.

However, the cross-border payments market is not static. It's anticipated to grow by 3-5% annually through the end of this decade, representing an additional £330 - £550 billion in cross-border flows within a £11 trillion realistic total addressable market. To contextualize, Wise's total volume is just over £100 billion, a fraction of the market. This includes only a mere £28 billion in SMB volume, which has a long runway for growth.

This landscape offers Wise a two-fold growth opportunity. Firstly, the market's natural expansion provides a robust backdrop for growth. Secondly, there's potential to significantly increase market share from such a low base. This combination indicates a long runway for growth for Wise before its revenue becomes cyclical and tracks the larger overall economy.

Moat Analysis: A Wise & Durable Competitive Advantage

In the fiercely competitive landscape of cross-border payments, the key to success lies in offering a distinct edge that elevates a platform as the go-to choice for consumers. The primary factors that matter for customers revolve around four pivotal elements: cost, speed, reliability, and transparency. A provider excelling markedly in these dimensions is primed for market leadership.

So, how does Wise distinguish itself amid such intense competition? Firstly, the company has meticulously constructed a unique infrastructure that is difficult for competitors to replicate. The substantial investment of resources, expertise, and time in this endeavor inherently establishes formidable barriers to entry. Secondly, Wise's strength resides in its dedication to sharing the benefits of economies of scale and improving unit economics directly with its users. This strategy not only fosters customer loyalty but also amplifies the platform's overall value proposition.

Together, these factors not only give Wise a strong edge over peers but also initiate a self-reinforcing cycle. The top-notch infrastructure provides Wise with a distinct advantage in cross-border payments, while its commitment to passing on savings boosts its appeal to customers. This increased appeal then fuels further growth and innovation, which in turn enhances the infrastructure and savings passed on to customers, completing the cycle and solidifying Wise's position as the industry's leading cost-effective choice.

The Correspondent Banking Problem

The prevailing correspondent banking model for international transactions is woefully outdated and inefficient, characterized by technological inertia that can persist for decades. This archaic system is particularly detrimental to consumers, as it typically requires the involvement of multiple banks to execute a single cross-border money transfer. This results in an intricate, costly, and sluggish process. The absence of direct banking relationships often adds further complexity, necessitating a series of intermediaries before the funds reach their final destination. Each participating institution charges its own fees, rendering the total cost opaque to customers due to the system's inherent complexities. The procedure is burdened with multiple layers of operational, regulatory, network, correspondent, FX, and liquidity expenses, contributing to its inefficiency. Each transaction triggers a cascade of obligatory AML, CFT, and KYC checks by each bank, a redundant process that slows down end-to-end execution. The lack of standardization in data formats further compounds the problem, inducing errors and necessitating manual intervention for inadequate message data, with Capgemini noting a 10% failure rate in bank transactions for straight-through processing (STP).

Additionally, disjointed operating hours among banks and FX markets, influenced by weekends and diverse national holidays, introduce additional delays. Batch processing by banks prevents simultaneous money transfers, leading to exacerbated bank-to-bank liabilities and further inefficiencies. These roadblocks to instantaneous processing extend transaction times to up to five business days — an intolerable delay in an era where people are accustomed to data moving as fast as instant text messages or domestic payment via platforms like Venmo or Zelle.

While fintech innovators such as Remitly, Revolut, and XE have greatly improved the user experience at the front end, the archaic back-end infrastructure remains mostly unchanged.

Mission Zero: The Path to Unlocking a Golden Opportunity

Undoubtedly, there's a vast opportunity for a cross-border platform to disintermediate the entire value chain by developing a superior network. Yet, this isn't a task that can be accomplished overnight—even for a resource-rich new entrant with a balance sheet of trillions of dollars and all of the world's top engineers. It demands a company with a genuine long-term vision, ready to patiently embark on the challenging journey of earning trust from regulators, obtaining direct access licenses for domestic payment schemes, and navigating the complexities of regional laws and regulations. However, in reality, competitors face resource constraints and are held accountable to quarterly, short-term investor expectations. For many businesses in the space, dedicating significant resources to an initiative that would take years to realize returns is not a viable option.

Wise is built differently. From its inception, the company was conceived with a transformative vision: to revolutionize cross-border transactions by sidestepping the existing inefficient system. This isn't just an addendum to the company’s goals; it's embedded in its DNA. Founders Taavet Hinrikus and Kristo Käärmann pioneered 'Mission Zero,' a term that embodies their steadfast dedication to driving customers' costs toward zero for cross-border transactions, encompassing FX markups and fees. Every facet of Wise, from its internal processes to its cross-functional teams, is aligned and dedicated to fortifying this objective.

Fortunately for Wise and its shareholders, this isn't mere speculation or an unattainable dream. After 13 years of relentless dedication and innovation, the Wise platform consistently and sustainably offers rates that are more competitive than banks, traditional MTOs, and even other digital-native contenders. For example, Wise’s take rate is 0.67%. In comparison, the average remittance cost is 12% for banks, 4-6% for traditional MTOs like MoneyGram and Western Union, and ~4% for digital-only providers. This works out to 6.24% on average, which means Wise is 10x cheaper on average (Wise conservatively claims up to 8x) and up to 18x on bank transfers.

This is not Wise artificially dropping prices and starting price wars to gain market share. Transfer costs for Wise are structurally much lower than the competition.

From publicly available data, Wise maintains a cost advantage of 5x - 8x over both digital-only platforms and traditional MTOs, boasting an average cost per transaction of only $1.03. At the same time, Wise charges on average a little over $2 per transaction, maintaining a healthy ~52% gross margin.

This is a big deal. Even if EuroNet—the parent company of Ria/Xe and the most cost-effective competitor in the sample set—were to drastically reduce its prices to compete head-to-head with Wise, operating at zero gross margins, its service would still be, on average, 2.5x more expensive than Wise's retail pricing. This underscores the remarkable cost advantage that Wise holds in the market.

Building a Low-Cost Fortress

Wise's cost-effective service is rooted in its foundational strategy. The company's inception traces back to the shared frustrations of co-founders Kristo Käärmann and Taavet Hinrikus. Based in London, they were frustrated by exorbitant currency exchange rates and fees. Their solution was a simple peer-to-peer model: Käärmann deposited pounds into Hinrikus's UK account and vice versa in Estonia, both using the mid-market exchange rate. This system, initially a personal solution, quickly garnered interest, leading to the birth of Wise.

This model's brilliance lies in its ability to intelligently move money domestically and match incoming and outgoing transactions, negating the need to physically move money across borders. However, as Wise expanded, challenges arose in corridors with imbalanced money flow. In such cases, Wise had to redirect capital, often relying on local banks for currency acquisition. This reliance diluted Wise's cost advantage. The solution? Wise focused on establishing direct connections to bypass intermediaries within domestic real-time payment systems. It also developed a proprietary, intelligent multi-currency ledger and a global real-time treasury management system to optimize its network.

Upon entering a new region, Wise initially collaborates with financial institutions (FIs) to establish a foothold. It then pursues regulatory approvals to directly access local payment systems. This direct access point is transformative, slashing costs and boosting transfer speeds. A case in point is their integration with the Fast Payment System (FPS), which led to a ninefold decrease in bank fees and a 96% reduction in transfer times, making transactions nearly instantaneous.

Core to Wise's sustainable competitive advantage is its proprietary global treasury management system that supports financial operations with real-time usage and liquidity forecasts, intelligent fund routing, and comprehensive accounting, foreign exchange, and risk management. This system offers a holistic view of global liquidity flows, optimizing investment decisions. It facilitates the cycling of funds globally to align with local payment schedules, enhancing payout speed. Leveraging this data, Wise has developed unique machine-learning algorithms to anticipate customer currency needs. Currently, about 50% of traded volumes are predicted, allowing for minimal working capital and maintaining low customer costs.

Lastly, Wise's growing customer network effect solidifies its competitive advantage. The more users Wise attracts, the more valuable and efficient its network becomes. Transfers between Wise users are instantaneous and straightforward, with transactions being mere ledger entries within Wise's system. This efficiency ensures that even large transactions, typically fragmented due to bank limits, are seamlessly executed on Wise.

These benefits afford Wise a substantial competitive advantage, making its system 80% more efficient than traditional banks on average, according to the company's claims.

Shared Economies of Scale: Building a Defensible Moat

While many companies are content with hoarding the benefits of economies of scale, Wise stands out by sharing these advantages with its customers. This commitment to redistributing tangible efficiencies is rooted in the powerful principle of shared economies of scale. As the business attracts more customers, its transaction volume grows. This increased volume allows Wise to distribute its fixed costs over a broader revenue base, leading to even lower prices.

Nick Sleep, a renowned London-based investor, eloquently described this phenomenon in the Nomad fund letters.

“Scale economics shared operations are quite different. As the firm grows in size, scale savings are given back to the customer in the form of lower prices. The customer then reciprocates by purchasing more goods, which provides greater scale for the retailer who passes on the new savings as well…Take Costco Wholesale: Costco’s advantage is its very low cost base, but where does that come from? Not from low cost land, or cheap wages or any one big thing but from a thousand daily decisions to save money where it need not be spent. This saving is then returned to customers in the form of lower prices, the customer reciprocates and purchases more goods and so begins a virtuous feedback loop.”

Wise's scaling efficiencies manifest in its expanding volumes, user base, and operating profits. Yet, since FY 2017, the global take rate has only dropped by 8%. Though this appears minimal, it's noteworthy given that Wise is already a market leader in affordability by a long shot. This figure somewhat understates the company's actual progress, as there have been substantial price reductions in more than 50 regions following improved integrations — including a 10% decrease in Brazil and an approximately 50% decrease in Mexico. However, gains from these reductions have been neutralized by headwinds such as FX volatility and a volume mix shift into newer, higher-priced markets.

But Wise's efficiency isn't just about pricing. From FY 2018 to FY 2023, the proportion of instant transfers (those completed within 20 seconds) surged by 4.5x. Impressively, more than 93% of transfers are settled within a day, a stark contrast to traditional banks and other fintechs, which often take 1-5 business days.

However, efficiency and cost savings would be moot if customers weren't sticking around. Fortunately, Wise boasts an annual volume retention rate of over 100% since FY 2019. Moreover, two-thirds of its new customers come through referrals, indicating high customer satisfaction. This viral organic growth means Wise can experience fantastic operating leverage as it spends significantly less on marketing compared to its competitors. For instance, Wise allocates only 4.5% of its revenues to marketing, in contrast to Remitly's 26.16%, Payoneer's 26.22%, and OFX's 7.5%.

Management & Culture

CEO Kristo Käärmann, with a background in mathematics, computer science, and finance, co-founded Wise after experiencing firsthand the inefficiencies of traditional banks in international money transfers. His vision was grounded in transparency, fairness, and customer empowerment, values that have since permeated Wise's corporate culture. Under Käärmann's leadership, Wise has championed a customer-centric approach, often involving customers in the product development process and maintaining an internal culture of collaboration, rapid learning, and adaptability. This ethos has propelled Wise to rapid global growth, transforming it into a key player in the financial technology sector.

However, Käärmann's journey hasn't been without controversy. He faced scrutiny after being investigated by the UK's Financial Conduct Authority (FCA) for tax default. This issue stemmed from an unpaid tax bill, leading to a substantial fine and raising questions about his adherence to regulatory compliance. Although Käärmann has since cleared the outstanding amounts and received continuous backing from Wise's board throughout the ordeal, the episode has undeniably inflicted reputational damage on both his persona and the firm. Furthermore, the situation has ignited speculation regarding the FCA's final verdict on Käärmann's suitability to helm an investment enterprise. This scenario inevitably raises concerns about the capacity of a CEO to effectively govern a corporation when his personal legal commitments have been found wanting, particularly in the finance sector, which is critically anchored on trust and stringent regulatory adherence. In spite of these tribulations, Käärmann persists in guiding Wise with the foundational innovative zeal that characterizes the company's essence.

Capital Allocation

The business stands out due to its low capital needs, requiring only .58% of revenues (ex-interest) over the past two years. However, capital expenditures are actually 1.47%, including cash outflows for intangible assets, which are comprised of internally generated software and licensing fees. Even with this adjustment, it remains a relatively minimal portion of the overall financial picture.

It's noteworthy that the majority of the firm’s infrastructural investments are expensed, scarcely reflected as capital assets on the balance sheet. This accounting approach results in administrative operating costs comprising a significant 58% of revenues, while concurrently having relatively low capital expenditures.

In my assessment, the management team has done a good job of allocating capital to augment its market position. There's an evident and steadfast dedication to reinvestment, a strategy manifested in the continuous strengthening of the company's infrastructure. The business should see operating leverage expand as it continues to grow its revenue, especially as it finds efficiencies in product technology and costly customer service operations from onboarding customers and manual verification needs — an expenditure that has recently outpaced revenue growth.

However, there's one aspect of the capital allocation strategy that prompts deeper scrutiny. Management seems to perceive share buybacks primarily as a tool to mitigate the dilutive effects of stock-based compensation. This approach, I believe, is somewhat limited in scope and potentially signifies a misunderstanding of the underlying principles of effective capital allocation, especially in the context of share repurchase strategies.

Warren Buffett has a clear stance on this matter: the prime scenario for buying back shares is when they are trading below their intrinsic value. This principle is grounded in the fundamental objective of enhancing shareholder value. By concentrating on offsetting dilution, management could be allocating capital suboptimally, potentially overlooking more advantageous investment opportunities for those funds.

Charlie and I favor repurchases when two conditions are met: first, a company has ample funds to take care of the operational and liquidity needs of its business; second, its stock is selling at a material discount to the company’s intrinsic business value, conservatively calculated.

Warren Buffett, 2011 Shareholder Letter

Contrast this to the statement from CFO Matt Briers on SBC.

Given our strong capital position we plan to reduce the impact of dilution from stock-based compensation. The intention is for the Employee Benefit Trust to acquire up to an initial £10 million of Wise shares in the market for this purpose over the remainder of FY23. We will continue to assess our plans beyond FY23.

While I think it’s too early to judge considering the business has only bought back £10 million of float, it is something worth considering.

Compensation & Equity Ownership

Wise's management compensation, equity ownership structures, and Employee Share Ownership Plan (ESOP) are strategically orchestrated to instill a culture of ownership and long-term value creation, crucial for aligning management's interests with those of shareholders. The ESOP is central to this alignment, designed to purchase Wise's shares on the open market or subscribe for newly issued share capital, thereby directly tying employees' fortunes to the company's success.

CEO Kristo Käärmann holds a considerable equity position in the company, possessing roughly 18.23% of the equity but, more critically, commanding 48.2% of the total voting rights. His choice to forgo the annual bonus and participation in the Long-Term Incentive Plan (LTIP) is a noteworthy gesture that strongly underscores his alignment with shareholder interests. This decision, in my view, reflects his assurance of Wise's long-term growth potential and indicates his level of dedication to investors. Furthermore, Taavet's venture capital firm controls 13.5% of the voting rights, granting the co-founders collective majority voting influence over the company's strategic directions.

However, this aggregation of a significant fraction of voting power with the co-founders, especially within the framework of Wise's dual-class share structure, might trigger governance concerns among minority shareholders. The central concerns stem from the potential emergence of conflicts of interest and centralization of decision-making authority. Given this substantial consolidation of voting clout, it's imperative for investors to harbor substantial trust in Käärmann's leadership and decision-making prudence.

Inverting the Thesis: Addressing the Main Risks

Intense Competitive Threats

Wise confronts formidable competition on multiple fronts. Traditional banks, which still command around two-thirds of the market and hold key financial relationships with their customers, are beginning to modernize their systems. They are exploring multi-lateral real-time cross-border payment systems with governmental bodies, interlinking domestic instant payment schemes, and streamlined payment technology, aiming to offer improved customer experiences, ultra-low FX rates, and clear, upfront pricing. This modernization not only represents a direct competitive threat but also could undermine Wise's edge. While banks garner support from central institutions to actively participate in these regional Fast Payment Systems (FPS), Wise may encounter escalating barriers to entry, potentially relegating it to a disadvantaged position. This gatekeeping is currently playing out in the United States as the Federal Reserve has to date limited access to the FedNow network exclusively to entities holding banking licenses, thereby excluding non-bank fintechs like Wise.

Moreover, one of the most significant risks arises from potential competitors, particularly large tech behemoths like Meta, Google, and X (formerly Twitter), which are venturing into payment services in some form. These companies' vast global user bases and deep financial resources allow them to invest in cross-border transfer services and offer them for free, cross-subsidized by other revenue streams, presenting a direct challenge to Wise's fee-based model.

Additionally, the market Wise operates in is characterized by low customer switching costs, meaning that users can easily shift from Wise to competitors or other apps with a few clicks of a button offering lower fees or better services. While Wise has endeavored to create customer stickiness through its Wise Account, the ease with which customers can switch services and shop around for the cheapest price could reduce its market prospects.

Thus, the combination of low barriers to entry, deep-pocketed new entrants, evolving traditional banks, and low switching costs — could create a precarious environment where Wise must continually innovate and adapt to maintain its edge.

Rebuttal

The competitive landscape in the cross-border payments market is evolving, with apparent threats emerging from various sectors, including tech giants and traditional banks. However, Wise stands resilient amidst these challenges, fortified by a singular company-wide focus and an already incredibly efficient infrastructure.

Wise's infrastructure advantage lies in the combination of a low average transaction cost and speed, which remains unrivaled by competitors. This provides a compelling value proposition that is difficult for new entrants to emulate, even for technology giants with large user bases. It's important to note that a large user base does not guarantee the successful replication of services or features. For instance, Google+ had the advantage of Google's vast ecosystem but still failed to compete effectively with Facebook. Similarly, Facebook Dating, despite the massive reach of its parent platform, has yet to significantly penetrate the online dating market dominated by incumbents. Even Threads, with initial high engagement due to its integration with Instagram, saw a precipitous drop in user interest over a short period of time despite its hype. A large user base, while beneficial, is not a guarantee of user adoption or engagement. Assuming low switching costs, success hinges on whether the new service provides tangible benefits for customers over existing, trusted alternatives. This challenge is not exclusive to fintech firms but also applies to tech giants eyeing the payments sector. Without a partnership with Wise, these companies wishing to offer cross-border services are relegated to the traditional correspondent banking system, which offers no edge.

Competitors, including banks, may offer their services for free or close to it, but these often involve cross-subsidization from other profit areas or infusions of equity capital such as with Atlantic Money, an unsustainable approach that fails to match Wise's cost-effective structure. When unprofitability becomes unacceptable, it pushes direct competitors like Revolut to shift strategies5, moving from FX as a loss leader to a focus on domestic accounts and other financial services, highlighting the complexities of the retail FX market. Unlike these firms, Wise's commitment to cross-border payments stands out in an industry where many have multiple competing priorities, resulting in neglecting the nuanced needs of a comprehensive cross-border service.

Banks also struggle to compete against Wise's network despite their significant market share. Incremental offerings intended to compete with Wise, like Santander's PagoFX, have met with limited success, leading to their discontinuation. This difficulty is further exacerbated by the fact that international money transfers typically constitute a relatively minor portion of overall revenue for larger banks meaning these institutions are not as incentivized to vigorously defend their market positions.

While the cross-border payments landscape is in flux, Wise's specialized focus, technological agility, and cost-efficiency give it a durable competitive edge. The company's unique value proposition has proven difficult to replicate, even for competitors with deep pockets and large user bases. As businesses attempt to encroach on Wise's territory, they often find themselves hindered by a lack of focus, outdated systems, or unsustainable financial models. Wise's resilience in the face of these challenges underscores its robust position in the market, making it a player unlikely to be easily dethroned.

Potential Substitutionary Threats: The Risks of Evolving Multi-Lateral Payment Systems and Digital Currencies

The landscape of global financial transactions is undergoing significant transformations, posing substantial substitutionary risks to Wise's model. These risks stem from two primary sources, the modernization of payment infrastructures through global initiatives and the shift towards digital currencies.

Firstly, the modernization of payment infrastructure by countries aims to facilitate more instant and efficient money transfers across borders. International collaborations such as IXB and Nexus are working to enhance the global connectivity of domestic payment systems, with the intention of empowering countries and financial institutions to directly facilitate efficient transfers without the need for proprietary networks.

Project Nexus, an initiative spearheaded by the Bank for International Settlements (BIS), stands out as a potentially serious competitor to Wise. In some ways, its architecture bears notable similarities to Wise's model, particularly in its objective to integrate with global instant payment systems (IPS). Unlike traditional methods that necessitate intricate, bilateral agreements and technical architectures, Nexus employs a standardized framework that simplifies both technical integration and legal compliance. By utilizing a decentralized network of Nexus Gateways operating under a unified scheme, the platform eradicates the need for complex country-to-country links that do not scale effectively. This innovation allows any participating region to make a single, one-time investment to connect, instantly unlocking access to all member countries and bypassing the need for resource-intensive, individual setups. Already, Nexus has proven its concept by successfully integrating with well-established IPS platforms like the Eurozone's TIPS, Malaysia's RPP, and Singapore's FAST. Furthermore, its design is geared towards fulfilling industry demands for rapid, cost-effective transactions, targeting a completion time of under 60 seconds for the majority of payments.

Should Nexus or any similar initiative gain traction and achieve success, the implications for Wise could be significant. A thriving cross-jurisdictional network that substantially enhances cost-efficiency and transaction speed for consumers could not only rival Wise's competitive advantages but also set new industry standards. Wise's operational model is deeply rooted in accessing and leveraging domestic fast payment systems. The success of such initiatives could dissuade central banks from granting Wise direct access to these networks, thereby challenging the company's strategic positioning.

Secondly, the global shift towards digital currencies—including both Central Bank Digital Currencies (CBDCs) and decentralized digital assets like Bitcoin—poses an additional disruptive element for companies like Wise. Governments and central banking institutions are vigorously pursuing the development of their own digital currencies, evidenced by approximately 90% of central banks engaging in CBDC initiatives. The impetus for these projects stems from a desire to retain regulatory authority and economic influence over domestic currencies, particularly as decentralized digital assets have witnessed a meteoric rise in adoption over the past decade, thereby challenging traditional fiat systems.

Drawing on data from McKinsey, as of 2021, one in ten adults in the United Kingdom possessed crypto assets, with comparably high ownership rates in other countries, including India (22%), Brazil (20%), and the United States (14%). Should any of these digital currencies emerge as the de facto standard for cross-border transactions, the demand for Wise's currency conversion services could experience a significant downturn. Specifically, CBDCs aim to revolutionize and optimize payment infrastructure, potentially enabling instantaneous and highly efficient international transfers.

Decentralized cryptocurrencies could pose a threat and gain broader acceptance if major issues such as regulatory gaps, technological limitations, and significant price volatility are resolved. The cost of converting cryptocurrencies to fiat is also a consideration; if these costs decline and transfer speeds improve, it might incentivize more users to opt for crypto-based transfers.

Rebuttal

Unified Modern Payment Networks

While the push for modernized, global payment solutions is noteworthy, these initiatives face significant challenges that make them unlikely to disintermediate Wise's proprietary solution.

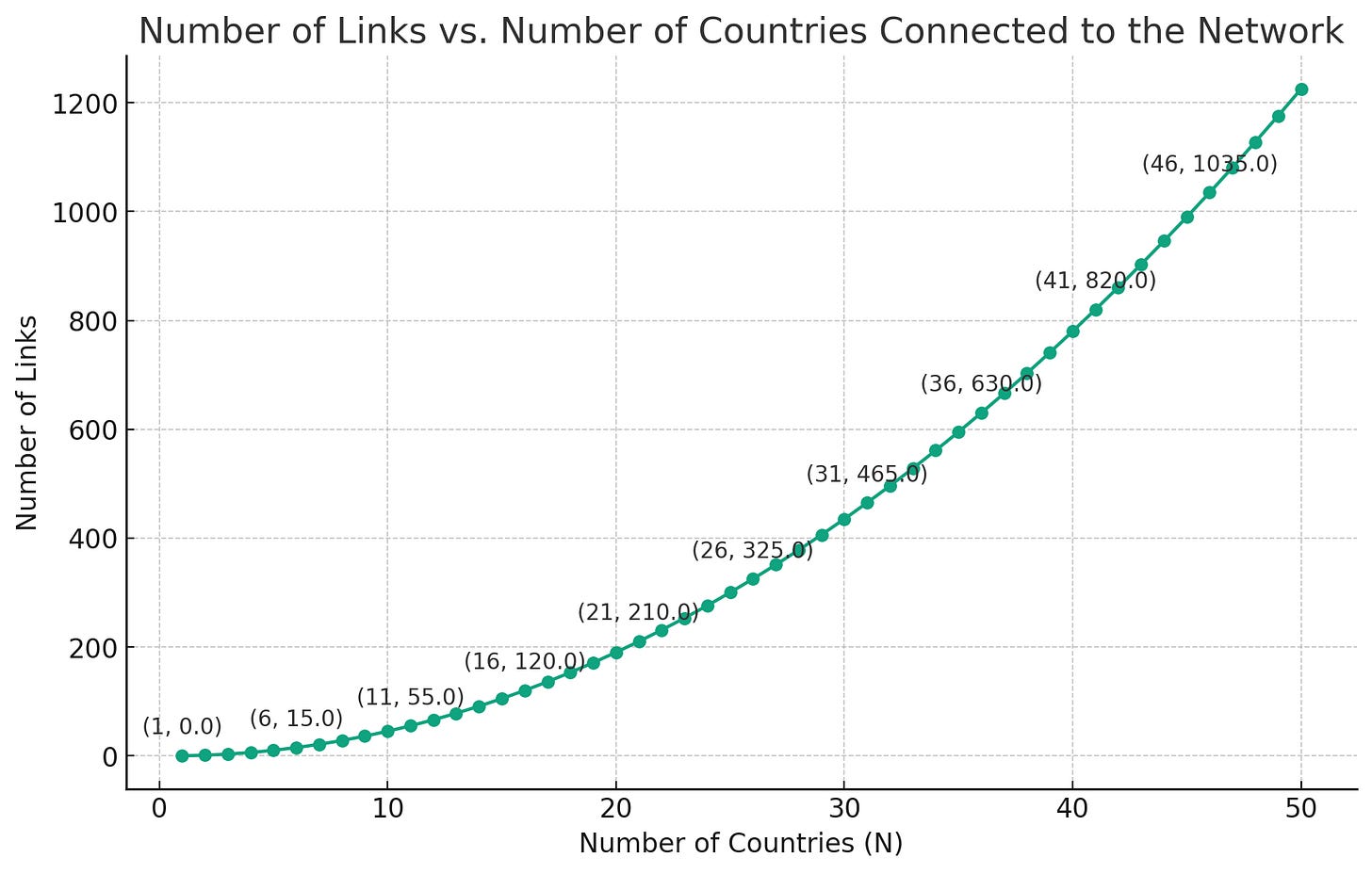

Firstly, the notion of universally linking all the world's payment systems is not practical. A network involving just 50 countries, for example, would necessitate a staggering 1,2256 bilateral links. Furthermore, each of these links comes with its own set of challenges, including varying regulations. The logistical and regulatory complexities not only escalate the costs but also extend the time needed to operationalize these systems. Even within a single country like the United States, achieving consensus on policy issues is a monumental task. When this is scaled to an international level, the complexity multiplies, potentially leading to delays, compromised effectiveness, or even outright failure of the initiative.

Secondly, as a workaround to the impracticality of universal interlinking, some initiatives are attempting to create a harmonized payment layer to which each node can conform to a single scheme such as with Nexus and P27. While this model shows promise, it is still rife with challenges. The U.S. Treasury underscores that these systems must navigate a labyrinth of key policy issues, including terms of access, payment messaging standards, and regulatory controls, all of which require consensus for a cross-border payment solution to be viable. This level of unanimity is certainly not a given. The case of P27 in the Nordics serves as a cautionary tale; despite high expectations, the project had to withdraw its second clearing application in early 2023 due to its overly ambitious and complex vision.

Our vision was to provide a better payments infrastructure to the 27 million people living in the Nordics, with an optimistic timeline. Lately, it is evident that our vision was too ambitious and complex. Hence, we need to reassess our future ambition in the Nordic payments market.

Paula da Silva, CEO of P27

Nexus, while an intriguing competing force, faces significant obstacles in establishing a robust global payment system. Unlike Wise, which has already invested for over a decade in building a scalable, efficient, and compliant infrastructure, Nexus is still in the early prototype stages of development and is competing with other global efforts. Wise's existing infrastructure allows for rapid, cost-effective transactions and has been fine-tuned to navigate complex regulatory landscapes. This gives Wise a considerable head start and a proven model, making it a formidable incumbent that Nexus must outperform to gain market share. Moreover, Nexus's not-for-profit utility model, while altruistic, can lead to inefficiencies and slow decision-making. Coupled with an untested fee structure and the reluctance of banks to transition from the lucrative correspondent banking system, Nexus is unlikely to easily or quickly replace Wise's customer-focused solution.

Digital Currencies

While Central Bank Digital Currencies (CBDCs) and cryptocurrencies like Bitcoin are gaining attention as potential solutions for cross-border payments, they are far from being a silver bullet that could replace Wise. For CBDCs, there is legitimate criticism that the overarching goal relates to policy and systemic objectives rather than improving the utility of payments for the actual people it serves. This lack of customer-centric focus raises questions about their practicality for everyday transactions. Moreover, CBDC projects face a host of challenges, including difficulties in project management, stakeholder alignment, and technical implementation. Public skepticism and fears of cybersecurity risks further complicate their rollout. These issues make it unclear whether CBDCs can offer the speed, cost-efficiency, and ease of use that Wise's infrastructure provides. There also may be some hesitancy for central banks of major currencies, particularly the US, to roll out such an unproven technology for fear of losing reserve currency status.

There's about two trillion dollars worth of Federal Reserve notes in circulation, and we estimate that somewhere close to half of that value in notes is held outside of the United States. The use of and trust in the dollar comes from the reliable rule of law, strong and transparent institutions, deep financial markets, and an open capital account. A healthy and efficient payment system demands these features, which reach far beyond the merely technological. So, we do think it's more important to get it right than to be the first. And getting it right means that we not only look at the potential benefits of a CBDC but also the potential risks and recognize the important trade-offs that have to be thought through carefully. We have a responsibility both to the U.S. and to the world that any steps taken for a U.S. central digital currency be taken safely.

Jerome Powell, Chair of the U.S. Federal Reserve

As for unbacked crypto assets like Bitcoin, the Financial Stability Board (FSB), a major international body comprised of representatives across 25 jurisdictions, does not consider them suitable for cross-border payments. In my view, without the backing of governments of the international community, it will be an uphill battle for Bitcoin to surmount CBDC. While cryptocurrencies offer certain benefits, such as global reach and decentralization, they are plagued by substantial limitations. For instance, Bitcoin's underlying technology is inefficient, with transactions taking an average of up to 1.5 hours to complete7. Moreover, its anti-establishment ethos creates significant regulatory compliance gaps. Trustworthiness is another concern, as illustrated by the dramatic collapse of the Terra Luna stablecoin. This volatility undermines its potential to serve as a viable alternative to fiat currency, both as a store of value and as a medium of exchange.

Lastly, the cost of converting cryptocurrencies to fiat currencies is often higher than fiat-to-fiat conversions. This makes cryptocurrencies less appealing for the actual use-case of cross-border payments. In contrast, Wise has already optimized its infrastructure to minimize transactional costs, providing a more appropriate solution for consumers and businesses alike. While digital currencies offer an interesting theoretical alternative, their practical limitations make them inadequate substitutes for the specialized services that Wise offers.

Where is the Operating Leverage?

There may be some concern about Wise's ability to achieve operating leverage, especially given the company's expanding customer base and network. While Wise showed promise from FY 2019 to 2022, recent trends indicate a divergence between revenue growth and operating expenses. Specifically, cost of sales and administrative costs surged by 73% and 58% YoY, overshadowing the company's 51% revenue growth. This raises questions about the sustainability of Wise's business model, particularly as it scales.

The company's CFO noted in the 2023 Annual Report that a significant chunk of the rise in operating expenses is due to Wise's aggressive hiring strategy, designed to enhance customer service and onboard 4.5 million new customers. To handle 24/7 support, the company has employed over 1,300 customer service agents. While this investment may elevate the customer experience in the short term, it raises questions about long-term profitability. Beyond customer service, Wise's operational challenges are multifaceted. Even with automation handling over a million documents a month, the company still requires manual oversight for labor-intensive KYC/AML checks, adding to its operating costs. This complexity may hamper Wise's ability to achieve operating leverage. On top of this, the company faces escalating legal and professional consultancy fees as it maneuvers through a complicated regulatory environment, holding 69 licenses across 45 countries.

Rebuttal

The concerns raised about Wise's inability to gain operating leverage due to escalating operating expenses may not paint the complete picture. First, it's crucial to consider that the company's aggressive hiring and customer onboarding are strategic long-term growth initiatives. In my view, at least a little over £100 million (~20%) of the operating costs are growth expenditures. This means that if Wise were to cut back on these growth initiatives, it could essentially double its normalized operating income.

Secondly, the critique fails to acknowledge the remarkable efficiency of Wise's automated onboarding and verification mechanisms. Contrary to the narrative that manual operations are a substantial bottleneck, Wise's technological infrastructure has demonstrated exceptional efficacy. As articulated by the executive team during the previous year's annual report conference call, the majority of new customers are 'onboarded with remarkable speed, predominantly through automated processes.' The firm has adeptly navigated a 40% surge in customer acquisition, seamlessly processing 20,000 applications and up to a staggering 1 million documents daily—over 90% of which are fully automated8. Moreover, Wise's 2021 prospectus revealed that 80% of customer support inquiries were resolved in a single interaction, underscoring the system's effectiveness not just in customer onboarding but also in expeditiously resolving customer issues with minimal manual intervention. Crucially, the accelerating processing speeds of customer transfers indicate that Wise is poised for ongoing efficiency improvements, as an increasing proportion of transactions go through STP without the need for manual intervention, thereby reducing operational costs.

Additionally, a more nuanced analysis of COGS since FY 2019 reveals that, despite a steep YoY decline in FY 2023, gross margin has actually been relatively flat or maybe a bit higher, especially when accounting for the unusually high FX losses incurred due to elevated currency volatility during that period.

Encouragingly, Banking and Customer-Related Fees as a % of revenue have decreased by 2.69 percentage points over this timeframe, signifying ongoing improvements in transactional efficiency.

Finally, the executive team is firm in its commitment to building for the long term. After a year of intense growth and hiring, the company is entering a phase of more measured expansion. The focus is on careful financial planning that aligns with the rate of business growth, all while maintaining a commitment to profitability. This approach suggests an anticipated deceleration in hiring in the forthcoming years, further calibrating the company's cost structure with its growth trajectory.

Last year was a pretty tiring year from onboarding and hiring people, like it was a pretty phenomenal -- amazing we pulled it off. But like we've done those yards and we lead into that. So definitely, the rates at which we are in going forward or growing the cost base at least -- ultimately, this alliance to the rate at which we grow sustainably fund that with the rest which are growing our -- the volume flows of the business. So that's right. And you can trust us to keep ahead of what we're seeing and plan very carefully and continue to run a profitable, sustainable, sustainable business over time.

Matthew Briers, CFO - 2023 Earnings Presentation

This careful planning and the one-time nature of onboarding costs suggest that the current rate of operating expense growth is not a long-term concern. Therefore, while the lack of operating leverage is a valid consideration, it should be evaluated in the broader context of Wise's growth strategy and operational efficiencies.

Valuation

Wise's operating earnings are driven primarily by two revenue streams, volume-based revenue and interest income. The former hinges on the multiplication of total market volume, Wise's market share, and total take rate (inclusive of cross-border take rate and other income).

Volume-Based Revenue

Total Market Volume × Wise’s Market Share × Total Take Rate The latter is the product of total volume, customer balances as a % of volume, and net interest yield.

Net Interest Income

Cross-Border Volume x Customer Balances as a % of Volume x Net Interest YieldIt's essential to understand the complexity and potential for error when attempting to estimate these inputs. However, armed with Wise's current data and a conviction in its growing durable competitive advantage and increasing market share in a steadily expanding market, one can formulate reasonable assumptions to gauge probable outcomes. Consequently, I will outline a scenario that, in my view, represents a plausible outcome.

For volume-based revenue, the persistent trend of escalating government debts, coupled with central banks monetizing these debts, suggests a continuous rise in overall market volume. Recent market volume growth has been torrid, expanding at a rate of 6-7% according to McKinsey, and around 5% from 2018 through 2022 as per EY's analysis. Although expecting this rapid growth to sustain indefinitely may be overly optimistic, a steady incline over the next decade is plausible. Hence, I will take a more conservative growth rate of 3%.

In this evolving landscape, Wise should progressively seize market share from traditional banks and other rivals. Given its strong position, a market share of just over 4%9 seems both reasonable and possibly understates its potential, equating to volumes of just over £600 billion. Forecasting the take rate is not easy, but I chose a lower figure than the current rate, predicting a dip in the cross-border take rate, partially offset by a minor uptick in 'other income' take rate.

Regarding operating margins, attaining a 20% margin appears achievable, particularly with the advantages of increased volume. This estimate might even lean conservative due to two factors: firstly, Wise already showcased its ability to achieve a 22% normalized operating margin in FY 2022, excluding interest income; secondly, industry precedence set by legacy operators like Western Union, who has maintained roughly a 20% margin despite less favorable unit economics. These inputs amount to nearly £5 billion in sales and operating profits of ~£950 million.

Regarding interest income, the ratio of customer balances to volumes expanded from 3% in FY 2019 to 10% in FY 2023. This may continue to increase dramatically, however, I have estimated 12% or £75 billion in balances. In my view, it is likely this ratio will continue to climb as Wise increasingly entices customers to deposit capital, especially as banks continue to be reluctant to sacrifice margin on deposits and transfer the higher rates to customers. For instance, the average interest rate on money market accounts stands at 0.65% APY compared to Wise's 4.33%10 in a US-based account. As of Q2 2024, the net interest yield is 2.9% against a 3.88% gross, suggesting that the company is over-earning on interest with a target margin of 20% versus 75% today. Predicting interest rates is notoriously challenging. Given the likelihood of ongoing inflation amid continuous money printing, a 1% yield, especially with the possibility of Wise being unable to hit the 20% target anytime soon, seems like a fair assumption. With these numbers, Wise could generate ~£750 million in net interest income. For context, the business generated £86 million in net interest post customer benefits in Q2 2024, translating to an annual run-rate of £344 or nearly half of this decade-long estimate, possibly underscoring a significant underestimate.

The sum of the two revenue streams adds up to £1.7 billion in EBIT. If just a few levers turn out to be better than expected, earnings should jump up quite a bit. For example, if Wise takes just 2% more in market share and the take rate is 1% with higher than expected other income or new revenue streams, operating income should be closer to £3 billion. For a franchise with £1.7 billion in operating earnings growing 22% annually, 15x EBIT or £25.50 billion EV is achievable. This represents a 14% CAGR on EV which should at least roughly approximate equity growth since the business actually has a net cash position of £400 million.

While looking ahead is great, it is more reassuring to see what type of yield investors are purchasing today. In FY 2024, this should be a business with an effective earnings yield of 5%. So far this year net interest income is £158 pounds or £316 annualized (though in reality, it should grow a bit higher with expanding customer balances). Revenue excluding interest has grown 35% TTM. Assuming a normalized EBIT (ex-interest income) growth of 20% for this year, you get to £164 million. Adding both income sources results in a normalized EBIT of £480 million, or earnings of £345 after £20 million in interest expense and a 25% tax rate. It is hard to go wrong with a 5% yield growing at a 20%+ growth rate.

Conclusion

In the rapidly evolving fintech landscape, Wise stands poised to cement itself as a leading force in cross-border payments. Its singular focus, robust infrastructure, and commitment to shared economies of scale have enabled it to establish a durable competitive advantage rooted in unparalleled cost-efficiency. While risks exist from intensifying competition and emerging payment networks, Wise's specialized model, forged over 13 years of dedication, provides a compelling edge that has proven challenging to replicate. Its remarkable growth trajectory, fueled by exceptional customer retention and minimal marketing spend, underscores the strength of its value proposition. Wise still has a vast runway for expansion across segments and geographies, supporting substantial revenue potential. Though uncertainties persist in predicting the future, Wise's resilience, adaptability, and customer-centric mission make it well-equipped to capitalize on the immense opportunities ahead. If the company stays true to its core principles that have paved its ascent so far, Wise is primed to play a pivotal role in transforming global finance for decades to come.

The annual cross-border volume for individuals and SMBs, according to Edgar, Dunn & Company.

Controversy has emerged regarding Wise's exclusion of Atlantic Money from its comparison tool, especially given that Atlantic Money imposes a flat £3 fee per transfer—a rate that is presumably below its own transactional cost.

Since Wise is not a bank, it is not able to directly pay interest to its customers in some jurisdictions. However, it is typically able to get around this by offering perks and other incentives.

Currently, targeting the large enterprise market segment remains impractical for the company. With a mere £9 billion in fees generated from a staggering £9 trillion in transaction volume—equating to a take rate of just 0.1%—alongside heightened liquidity requirements, this segment presents formidable challenges.

Refer to remarks made by Harsh Sinha, Wise's CTO, at the Morgan Stanley European Financials Conference in 2023 for further insight on this topic.

In graph theory, a fully linked network is a complete graph, where the number of links (n) can be calculated with the following equation:

This is in comparison to Wise which transacts 60% of transactions under 20 seconds and ~80% under 1 hour.

91% of personal document review was automated, according to the Wise 2021 Prospectus.

Wise has a 1% market share today across the personal and SMB markets.

As of November 1, 2023