RH: Liquidity Problems Have Changed the Story For Now

Aggressive Buybacks and Rising Debt Pose Short-Term Risks Despite Long-Term Potential

$RH Valuation on Publish Date

Price Per Share (Close): $324.32

Market Cap: $6 billion

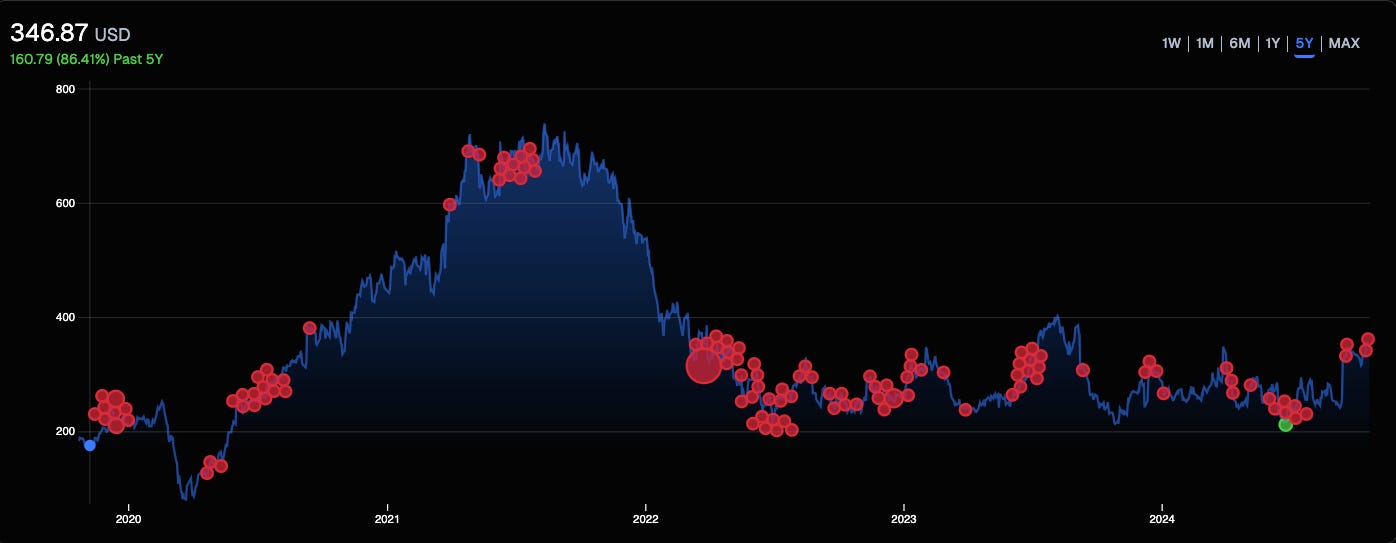

Enterprise Value: $9.78 billionIn June 2023, I conducted an in-depth analysis of RH (RH 0.00%↑), formerly Restoration Hardware, highlighting its substantial long-term potential. I have confidence in CEO Gary Friedman, an "Outsider" CEO—leaders who utilize unconventional and highly effective strategies to increase shareholder value over time, as described in William N. Thorndike Jr.'s The Outsiders—and in RH's standing as a premier luxury furnishings company. However, recent questionable capital allocation decisions have weakened RH's balance sheet, creating liquidity risks that could lead to equity dilution if cash flow does not improve. Consequently, I sold my shares at $340, realizing a 17% profit in just over a year, despite intending to hold for the long term. I may consider reinvesting if the balance sheet strengthens, but current liquidity issues have led me to remain on the sidelines.

What Happened?

In Q2 2021, RH maintained a strong balance sheet with $291 million in cash and $558 million in debt (excluding leases), primarily from two hedged zero-coupon convertible bonds and $2 million in promissory notes. The company generated an impressive $662 million in operating cash flow (OCF) at the peak of the COVID-driven housing boom, followed by $400 million the subsequent year as the boom tapered off, making the debt comfortably serviceable at the time.

Then, in the fall of 2021, RH took on a $2 billion term loan (Term Loan B or TLB) at a floating interest rate of LIBOR + 2.5%. The rationale? It was intended to “create substantial optionality” as RH invested to position itself as a premier global luxury brand. The leadership, particularly Gary Friedman, viewed it as an “attractive cost of capital.” Fast forward to May 2022, and RH took on another $500 million loan (Term Loan B-2 or TLB2), this time at SOFR + 3.25%. Again, he confidently described it as a "fantastic long-term opportunity" for shareholders.

But what did he end up doing with the cash?

In 2022, RH repurchased 3.7 million shares for $1 billion. However, employees exercised 4.2 million stock options that year, including 3.9 million expiring options from Gary Friedman himself, leading to a 2.5% increase in outstanding shares. Then, in early June 2023, RH repurchased another 3.7 million shares between June 14 and July 13, this time for $1.2 billion. Altogether, ~90% of the cash from the term loans was used for stock buybacks—a clear signal that the CEO believed the stock was significantly undervalued.

“I think we made a relatively aggressive move here. We bought 17% of the business at a really attractive price, and I think our shareholders will benefit from that. If our view is right over the next couple of years, it's going to look like a really great investment.

How aggressive we'll be in future quarters? I think you've looked at us historically. We're kind of optimistic opportunistic. We're not like a big corporation that sets up a regular buyback every quarter and stuff like that. I mean, if that was smart to do, Warren Buffett would do it, right? Warren Buffett is a very opportunistic repurchase of their stock. We're trying to be opportunistic investors, whether it's in our stock, whether it's in anything that we do.

So we think this was a great time to deploy capital and buy back a meaningful position in our company. And it depends what the market does, depends on what we see and how we feel, and what we'll do in the future.”

CEO Gary Friedman — Q2 2023 Conference Call

Gary Friedman’s decision to aggressively repurchase shares, as an owner-operator holding over 20% of the company, was nothing short of audacious. This bold capital allocation strategy exemplifies the visionary thinking that initially attracted me to RH, demonstrating a strong conviction in the future and the company’s intrinsic value.

However, in his enthusiasm, Friedman may have overextended the company’s leverage. This pivotal decision to buy back shares significantly eroded RH’s cash reserves, plummeting from $2.2 billion in Q1 2022 to a mere $417 million by Q2 2023. Concurrently, net debt surged from $1.3 billion on an $8 billion market cap to $3.3 billion on a $7 billion market cap, marking a substantial recapitalization of the balance sheet.

I fully support aggressive buybacks when a stock is undervalued, as it is far superior to management indiscriminately purchasing shares to offset dilution from share-based compensation. However, this should not come at the expense of overleveraging the balance sheet, especially when anticipating a significant down-cycle. Expanding aggressively while stretching financial resources can be dangerous. Investing during a downcycle by enhancing RH’s footprint with more luxurious galleries and revamping collections to bolster its position as the leading luxury furnishings brand is an exceptional long-term strategy to dominate. Nonetheless, this approach becomes unwise if the company cannot sustain its growth through operational cash flow or existing cash reserves. This setup left little room for RH to navigate prolonged economic challenges, potentially jeopardizing its ability to survive an extended industry downturn.

A Costly Mistake Heading Into a Storm

Unfortunately, Friedman’s timing was poor when he decided to ramp up leverage with variable interest rate debt, coinciding directly with the onset of an aggressive Federal Reserve hiking cycle to tame inflation.

“We raised the capital for to provide optionality and give us some flexibility here going forward. We accomplished that at a very attractive rate.”

CEO Gary Friedman — Q4 2021 Conference Call

At the time of the TLB issuance in October 2021, LIBOR was approximately 0.1%, resulting in an interest rate of around 3% on the $2 billion loan, with a 0.5% LIBOR floor, equating to $60 million annually. For TLB2, the initial effective interest rate was roughly 4.15% based on a 0.8% SOFR (which replaced LIBOR), amounting to $21 million annually. Combined, these original interest payments totaled $81 million. Fast forward to Q2 2024, just before the 50 basis points FED cut in September, SOFR had risen to 5.33%, pushing the interest rates on these term loans to 7.96% and 8.69% for TLB and TLB2, respectively. This translated to $212 million in TTM term loan interest payments—a staggering 162% increase. When you include interest expenses on finance leases, RH’s total interest expense over the past twelve months consumed $246 million of EBITDA.

This surge in interest expense might have been manageable had the operating environment remained as robust as it was when the loans were initially underwritten. Unfortunately, the rise in interest rates delivered a double blow to cash flow: not only did higher interest payments reduce cash flow, but there was also a significant slowdown in the housing market. By the end of 2022, luxury home sales had plummeted by approximately 45% due to a lack of supply and skyrocketing mortgage prices driven by FED rate hikes, making mortgages unaffordable for many.

Despite a growing restaurant business, which likely contributes under 7% of sales1, the bulk of RH’s revenue stems from home furnishings. Consequently, the sharp decline in housing sales volumes had a material impact on the business, reflected in the drop from $1,033 million in FY 2021 EBITDA to $387.1 million TTM.

Moreover, there was a third critical issue. The CEO’s long-term vision led to an ambitious expansion of galleries both domestically—primarily through gallery conversions—and internationally. This expansion drive caused capital expenditures to rise from $185 million in FY 2021 to $303 million TTM, further straining free cash flow.

Offsetting these cash outflows was a large $113 million increase in Accounts Payable (AP), nearly doubling YoY in the last quarter. RH put pressure on its suppliers to conserve as much cash as possible, which drove AP and Accounts Expenses (AE) to an all-time high of $477 million. However, this measure only partially offset the impact, as the company still burned through $281 million in FCF over the trailing twelve months, compared to nearly $500 million in positive free cash flow for FY 2021.

A Stretched Balance Sheet

The negative cash flow, coupled with the already depleted reserves from the buybacks, reduced RH’s cash reserves to a precarious $78 million last quarter. In reality, without a $25 million drawdown on its asset-based credit facility (ABL), the cash position would have been even more dire. This was a red flag for me, indicating that RH might lack the necessary cushion to operate as a business without resorting to additional debt or equity raising.

Unfortunately, the Liquidity and Capital Resources section of the latest 10-Q brought even worse news: the company further drew down the ABL to $110 million after the quarter ended.

“As of August 3, 2024, we had $25 million outstanding under the asset based credit facility, which increased to $110 million as of September 6, 2024. The additional borrowings support our continued investments, including into inventory of new collections and existing collections, as well as capital expenditures for our Design Gallery expansion.”

Q2 2024 10-Q

This development confirms my concerns. In the third quarter, RH is still not generating sufficient cash from operations, despite recent positive revenue growth, to sustain both its core operations and growth ambitions. That said, the company still has some breathing room before exhausting its ABL availability. At the end of the quarter, before accounting for the 10% Fixed Charge Coverage Ratio (FCCR) limit, net availability stood at $498.5 million, after factoring in a $45 million letter of credit and the initial $25 million drawdown. Including the FCCR limit, RH had $439 million left to borrow2 under this credit facility. However, with an additional $85 million drawn, the effective headroom has shrunk to just $354 million. There is also a $300 million incremental accordion option available, but since this is entirely at the discretion of the creditors, I wouldn’t count on RH being able to access these additional funds.

Additionally, RH has just $121 million in cash remaining3 on the balance sheet, which includes a $42 million 2024 Convertible Note due in September—providing roughly 1.68 years4 of runway including the ABL at the current cash burn rate. It’s important to note, though, that this run rate is an oversimplification. The business is highly leveraged both financially and operationally, with a large fixed asset base from galleries. A nuanced understanding of future revenue trajectories is essential to gauge how long RH can sustain its current financial obligations.

Steep Debt Servicing Obligations

Unfortunately, the ABL is a floating rate debt, calculated as the base rate plus a margin. At the end of the quarter, this amounted to 6.69%. Assuming a post-FED cut rate of approximately 6.19%, the incremental interest of around $7 million, doesn’t help RH's situation. Without any changes in interest rates, RH will need to service $192 million in annual interest payments5 across all three credit facilities over the next 12 months.

On the positive side, the ABL is not due until mid-2026, and the term loans are scheduled to mature in late 2028, providing RH with some time to manage and repay its debts. However, the bad news is that the company faces additional debt servicing obligations beyond critical operational cash needs. Specifically, RH had $42 million in convertible senior notes due in September, which was a primary reason6 for the additional ABL borrowing. Additionally, there are ~$25 million in mandatory annual principal payments on the term loans.

From an operational standpoint, RH anticipates spending between $117 million and $167 million in additional capital expenditures through the end of the year to reach its full-year capex target of $250 million to $300 million. Compounding this are the $477 million in AP/AE liabilities that RH must pay out to suppliers, employees, and other third parties. The sales-to-AP/AE ratio has fallen to 6.3x, the lowest since 2015 and significantly below the average of 8.12x. To preserve healthy relationships with its partners and fulfill financial commitments, shareholders might see well over $50 million in AP cash flow outflows over the next year, which would further strain free cash flow.

Assuming there are no significant changes to interest rates or capital expenditure plans, RH faces a minimum of $488 million in cash outlays7 over the next twelve months, excluding AP/AE. With only $121 million in cash remaining, if RH's EBITDA remains around $387 million or lower and the company cannot reduce its growth capital outlays, it will be forced to draw further from the remaining ABL. This scenario would eventually necessitate exploring alternative financing options such as equity issuance, sale-leasebacks, asset sales (which seems unlikely given the criticality of real estate to the brand), or taking on additional high-interest debt—assuming creditors are willing, which is a significant uncertainty.

Interestingly, during the Q2 conference call, there were no mentions of the balance sheet situation. It is striking that neither the CEO nor the CFO addressed these concerns, which might suggest they are not overly worried, or they chose not to discuss the balance sheet's condition to avoid alarming the market. While the quarter's results indicate that RH is potentially on a path to a positive inflection, the lack of transparency regarding financial stability remains a significant concern.

Will an Inflection Save the Day?

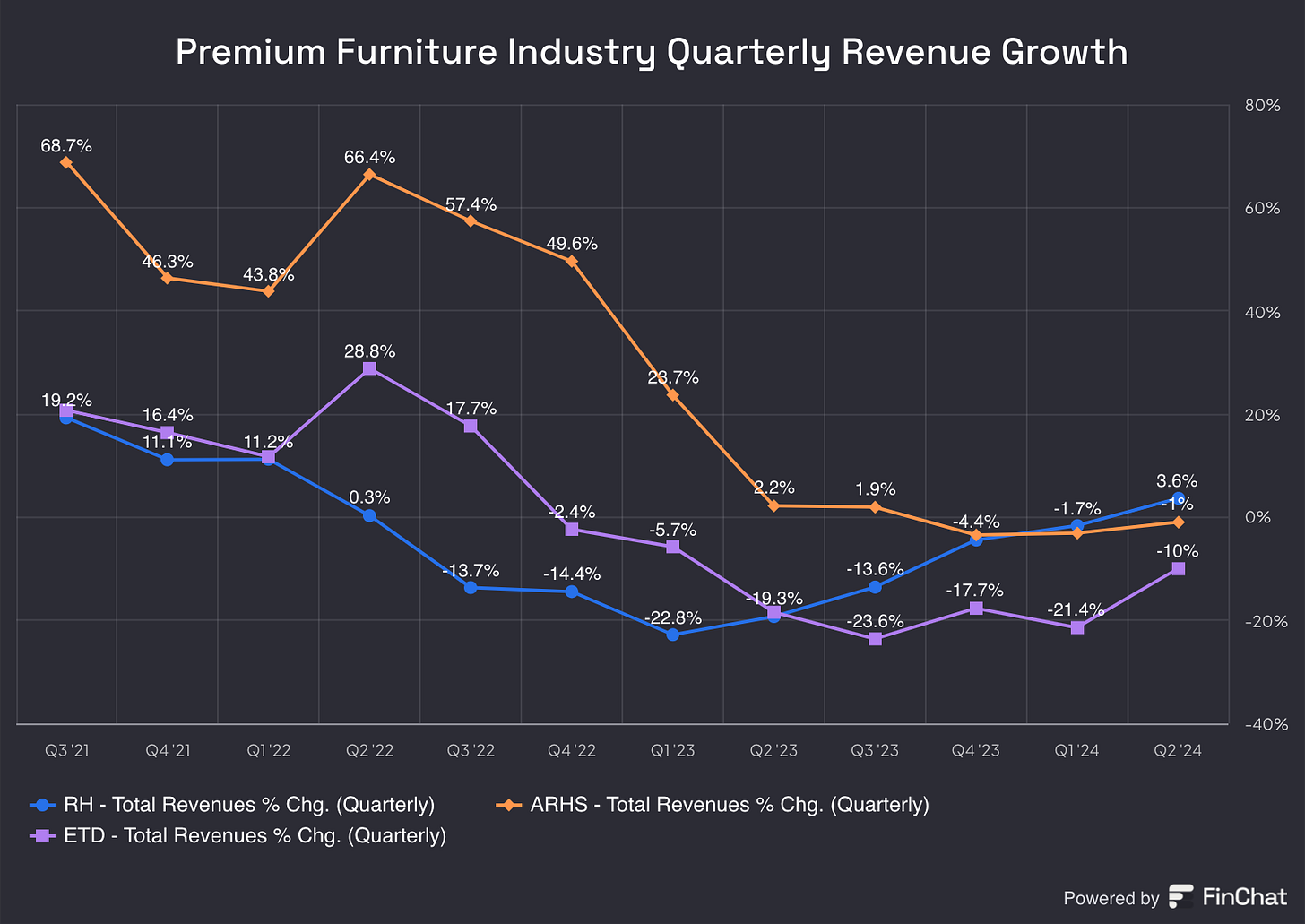

RH shareholders, including Gary Friedman, remain hopeful that the long-awaited inflection point for the business has arrived. After enduring seven consecutive quarters of YoY revenue declines, RH finally reported a positive quarter in Q2 with a 3.6% sales growth.

The market responded enthusiastically, with RH’s stock surging by 42% at its peak post-earnings within the first two weeks. This sales growth aligns with the improving luxury housing market, characterized by increasing inventories of luxury homes, a positive uptick in luxury sales, and decreasing mortgage costs fueled by expectations of multiple Federal Reserve interest rate cuts. I also shared this optimism, anticipating that RH would excel as the scaled player in the luxury furnishings sector. After all, housing purchases and refurbishments typically trigger substantial, high-ticket decisions, including furnishings. However, despite the encouraging results, my concerns about worsening cash flow and mounting debt have grown, revealing troubling trends that don’t quite fit the turnaround story.

Digging Beneath the Surface

Several concerning trends have emerged in the data. Although RH has posted positive revenue growth since Q1 2023, the trend in customer deposits has significantly diverged, declining by ~8.5% over the last two quarters. Historically, the growth of customer deposits relative to sales has been a strong indicator of future revenue growth. When customers make upfront cash deposits in anticipation of receiving merchandise, it signals robust demand and secures future sales. If RH were truly experiencing an inflection similar to late 2019, we would expect deposit growth to outpace revenue growth or at least track it. Instead, deposits are on the decline.

At the same time, AR surged by 22.4%, accounting for ~36% of the quarter’s total sales growth. AR primarily consists of credit card receivables from payment processors and trade contract (B2B) receivables. Since credit card receivables typically grow in line with sales, the sharp trend deviation suggests that RH's contract receivables are likely the main driver. This implies that the business may be extending more credit to trade customers than in the past.

Looking at the entire picture, it appears that RH is easing its payment terms, increasing the proportion of credit sales, and reducing upfront cash requirements for trade and retail customers to stimulate demand. Concurrently, since cash inflows have slowed, RH is deferring payments to suppliers to conserve cash. The accompanying graph vividly highlights this dramatic surge in AP.

Show Me the Incentives and I’ll Show You the Outcome

Why might RH be more lenient with customers while being stringent with its partners on payment terms? The incentives become clear when considering Gary Friedman’s ongoing narrative. He has been steadfast in asserting that the inflection point has arrived, even going so far as to discuss it publicly on platforms like Mad Money.

Reflecting on the Q4 2022 conference call, Friedman anticipated a significant inflection in the second half of 2023 due to an upcoming product transformation. This expected turnaround did not materialize in the time frame he expected beyond an improvement from very negative growth to less negative growth.

Additionally, since the beginning of fiscal 2024, RH introduced a new non-GAAP metric called Demand. According to the SEC filing, Demand represents the dollar value of orders placed before they convert to revenue—the orders only translate to sales once customers receive their merchandise. He advised investors and analysts to focus on this metric as a better indicator of inflection until the business could fine-tune its SKU assortment and optimize the supply chain. He says this is necessary because sales lag behind demand by 4 to 8 points due to long order fulfillment lead times and large backlogs, while the company adjusts to demand signals from its product transformation.

“While it's a climb that becomes more difficult as we reach new heights, it's also one we've navigated successfully over the past 22 years, so don't expect us to waver from our vision anytime soon. This spring and summer, we will be unveiling the most prolific collection of new products in our history, with over 70 new furniture pieces. These new collections reflect a level of design and quality that is currently inaccessible in the market and offer a value proposition that will be disruptive. We also believe the new collections will generate excitement and serve as an inflection point for our business in the second half of the year. The new pieces will grace the pages of a newly designed sourcebook, with the goal of creating a cohesive collection of titles, reinforcing our leadership in design and quality.”

CEO Gary Friedman — Q4 2022 Conference Call

On the surface, RH is on the right track. Demand grew by 3% in Q1 and 7% in Q2. However, management has consistently overestimated demand growth by at least 1 to 3 percentage points each quarter, despite having clear visibility and guidance for each period. For instance, in Q1 2024, the company guided for mid-single-digit demand growth, and in Q2, the guidance was 9-10%. While I can acknowledge that the CEO might be slightly ahead of himself and premature in his predictions, directionally, he is correct. As a long-term investor, this isn’t necessarily a problem. However, given the current balance sheet situation, it feels like RH needs to generate cash flows now, making mere directional accuracy insufficient. Therefore, the decline in customer deposits and the sharp rise in AR are deeply concerning. If the gap between sales and customer deposit growth seemed significant, the difference compared to demand was even more striking—nearly 16% last quarter.

While I appreciate that the CEO has provided investors and analysts with more insight into the business fundamentals through the new metric—and I welcome this level of transparency—he has now placed himself in a position where immense pressure exists to meet short-term results. This pressure stems from the need to satisfy Wall Street expectations, earn conditional lucrative restricted performance stock options, and maintain solvency. This increasing need to shift toward short-term thinking is antithetical to the long-term visionary leadership ethos Gary Friedman has consistently communicated to the market, which is not the story I originally invested in.

Dissecting the Inventory Build-Up

Inventory growth has outpaced sales growth since Q4 2023. Typically, a steep rise in inventory relative to revenues signals potential issues for a retailer, such as difficulties in moving products or overestimating demand. While I acknowledge that RH has struggled with demand, there is a legitimate explanation for the inventory build-up. The brand has recently undertaken its largest product transformation in history, refreshing approximately 80% of its SKUs. In this context, it remains unclear whether the inventory buildup is detrimental. Ultimately, it will depend on RH’s ability to effectively turn over inventory within the next year.

Here is what the CEO had to say when asked about the high inventory levels:

“A lot of it is a kind of insurance, right, of like how do you make the transition from here to there, how do you not things like drop out and run out of this before you built a bridge to there and all of a sudden you lost business. You just expect we're coming for this and so and you're learning every time in a big transition like this, never done this before. So we're doing all our math and saying how do we get from here to there and then we had early learnings and like, oh gosh, we're getting out of that too fast, hold on, like how do you optimize. So we're learning.

But yes, there's like an insurance policy, call it inventory, to kind of get from where we are to where we're going. And exactly where we're going, we know directionally where we're going. We don't know exactly what that the makeup for the pieces and the percentages and the like what's optimal now. We're going to learn new things. And so as we learn, you'll learn, I'd like to say.”

CEO Gary Friedman — Q4 2022 Conference Call

The narrative presented by management is that they ramped up inventory in anticipation of an inflection in demand, using it as a temporary safeguard against potential stockouts or missed sales. Management is still determining which new products resonate with consumers, necessitating a broader array of SKUs until they can identify and focus on what works while trimming what doesn’t. Unfortunately, this strategy introduces another cash flow headwind until RH can optimize and calibrate its inventory levels effectively. I would appreciate a more granular breakdown of inventory newness in filings, distinguishing between older and newer SKUs, to better assess whether the new products are truly resonating with consumers so that RH can continue to climb the luxury ladder.

Unfortunately, the scuttlebutt suggests that the increased demand may be primarily driven by older inventory rather than the new products Gary Friedman emphasizes. Matt McClintock, who closely tracks RH’s metrics, has observed that since September 2023, RH has steadily ramped up promotional and discount emails to customers. He notes that the rise in these emails, which typically feature older inventory, correlates with the uptick in demand.

Moreover, while inventory has likely grown due to management increasing the stock of newer collections, customer deposits have declined sharply. This contrasts starkly with the initial surge following the 2015 launch of RH Modern, where deposits grew by 45-60% over multiple quarters, driven by strong customer demand for the new product. In my direct communications with Matt, he highlighted that if newer collections were truly the main driver of demand, there would likely be a noticeable shift from RH Outlet sales to online sales. Outlet consumers typically receive goods immediately, eliminating the need for deposits, whereas online purchases typically involve a multi-week lag from shipment to receipt. Therefore, a real increase in demand for new products should have led to higher customer deposits.

Additionally, RH has expanded its gallery square footage by 14% and increased the total number of galleries by 6.1% since the beginning of 2023. This growth includes international expansion and domestic gallery legacy conversions, indicating that a material amount of the increased demand and revenue growth may be attributed to square footage expansion rather than a significant improvement in the core business.

In fairness, RH's sales growth is currently surpassing that of its public premium furnishings peers after a period of underperformance. While Arhaus experienced substantial growth through 2022, its expansion slowed significantly in 2023, and in 2024, RH has outperformed it. Ethan Allen is in even worse shape, having lagged RH considerably since the end of 2023. However, this outperformance holds little significance unless it translates into positive free cash flows and effective deleveraging in the near future.

Insider Activity

The CEO is the only insider who has recently purchased shares, making a $10 million voluntary buy in June. Initially, the market responded with enthusiasm to this move. However, I don't place much weight on it because the shares bought represent only a 1.4% increase in the total shares he already owned. I’m skeptical of such actions, as I’ve observed similar token purchases from other management teams, such as Warner Bros Discovery, which seem more aimed at projecting confidence and supporting the stock rather than demonstrating a genuine conviction in future outperformance.

Aside from Friedman’s purchases, insiders have primarily been selling their shares. On the surface, this may not be alarming, as many insiders routinely sell shares after exercising options to monetize their compensation packages. However, it is concerning to see long-term insiders like Stefan Duban—who has been with the company for 24 years and has never sold before—exercise his options prematurely and cash out. While I might be overinterpreting this behavior, it remains disconcerting.

Conclusion

Despite outperforming some premium furnishings peers, RH faces significant risks due to negative free cash flow and rising debt. The recent stock surge masks these financial vulnerabilities that may hinder RH’s ability to sustain growth without further diluting shareholder value or resorting to costly financing options. Aggressive capital allocations, particularly debt-funded share buybacks, have weakened the balance sheet, leading to liquidity issues and higher interest expenses. These factors undermine short-term stability and erode my confidence in RH's financial health.

Even though RH faces significant short-term risks due to its financial vulnerabilities, I remain confident in the company’s long-term potential, driven by its strategic investments and leadership in the luxury furnishings market. This has positioned RH to dominate the higher end of the industry, which is precisely what drew me to the company initially. Investing during a downcycle is exactly what enables RH to strengthen its market position and thrive in the future. It's noteworthy that competitors have often performed worse—some have declared bankruptcy, and brands like Arhaus and Ethan Allen have struggled more than RH since 2023. Despite Gary Friedman’s propensity to be overly optimistic and often incorrect in his predictions, no one can dispute the value he has delivered to RH shareholders—a ten-bagger since its listing in November 2012, transforming the brand from a tacky tchotchke-selling store to a luxury/premium brand.

While the company's long-term trajectory remains compelling, the liquidity challenges heighten risks and render the investment speculative at the moment. I will wait on the sidelines until RH restores its balance sheet and demonstrates clear financial stability.

RH does not explicitly disclose its Food & Beverage (F&B) sales figures. However, during the Q4 2021 conference call, CEO Gary Friedman revealed that average restaurant sales were approaching $10 million. In the last 10-Q, RH stated that the company has “an integrated RH Hospitality experience in 18 of our Design Gallery locations, which includes restaurants and wine bars.” This encompasses RH England, which features multiple hospitality venues, although some galleries have struggled with low foot traffic due to their rural locations. Based on the available information, it is reasonable to estimate that RH's F&B sales are below $200 million. Even if this estimate was off by 25%, F&B sales would still represent a relatively small portion of the company's total $3 billion in annual sales.

The Q2 2024 10-Q states the following: “As of August 3, 2024, RHI had $25 million in outstanding borrowings and $499 million of availability under the revolving line of credit, net of $45 million in outstanding letters of credit. As a result of the FCCR Covenant that limits the last 10% of borrowing availability, actual incremental borrowing available to RHI and the other affiliated parties under the revolving line of credit would be $439 million as of August 3, 2024.”

$78 million Q2 2024 Cash + $85 million drawn from ABL since quarter end - $42 million 2024 Convertible Note paid in September = $121 million

($353 million remaining ABL + $121 million cash on BS) / 281.9 million FCF burn run-rate

$145 million TLB + $40 million TLB2 + $7 million ABL

The Q2 2024 10-Q states the following: As of August 3, 2024, we had $42 million remaining in aggregate principal amount of the 2024 Notes, which have a scheduled maturity in September 2024. We anticipate borrowing additional funds under the asset based credit facility to repay the principal amount of the 2024 Notes in cash with respect to any convertible notes for which the holders elect early conversion (if applicable), as well as upon maturity of the 2024 Notes in September 2024.

$250 million cap ex + $192 million credit facility interest payments (Term Loans & ABL) + $25 million term loan mandatory payments + $20.83 million in finance lease costs (not included as an expense in EBITDA)

Note on Cap Ex: Although the CEO could potentially reduce capital expenditures if necessary, RH's firm growth plans mean that the $250 million may represent a minimum required to maintain its current velocity. Additionally, the CEO has expressed reluctance to slow down construction, as doing so would lead to increased total build costs.